Nowadays, dozens of online brokers offer trading services, making it difficult to decide which platform to sign up to. Therefore, to help our readers, we’ve researched some of the top brands in the industry to make the selection process easier.

Our guide compares the top 10 online trading brokers, focusing on their offerings, fee structures, user interfaces, support services, and regulations. After reading this guide, you’ll know more about the best 10 brokers and what criteria to consider when choosing a suitable option.

Key Facts Online Trading Brokers

- Selecting the right online broker involves evaluating their market access, fee structures, platform usability, support services, and regulatory compliance.

- Distinguishing features of top brokers include diverse financial products, user-friendly trading platforms, and competitive fees.

- Regulatory compliance ensures investment security, making it a critical factor in choosing a broker.

- Advanced and intuitive trading platforms cater to both beginners and experienced traders, providing necessary tools for effective trading.

- Customer support quality and availability are key for resolving issues and providing assistance.

- Transparent and reasonable fee structures are essential for cost-effective trading.

List of the Best 10 Online Trading Brokers:

- RoboForex: Known for its high leverage options and comprehensive trading platforms including MetaTrader and cTrader.

- FP Markets: Offers a rich trading environment focused on forex and CFDs with competitive pricing and advanced guides for using MetaTrader 4.

- Vantage Markets: Provides direct market access with a focus on forex and commodities, supporting educational resources for traders.

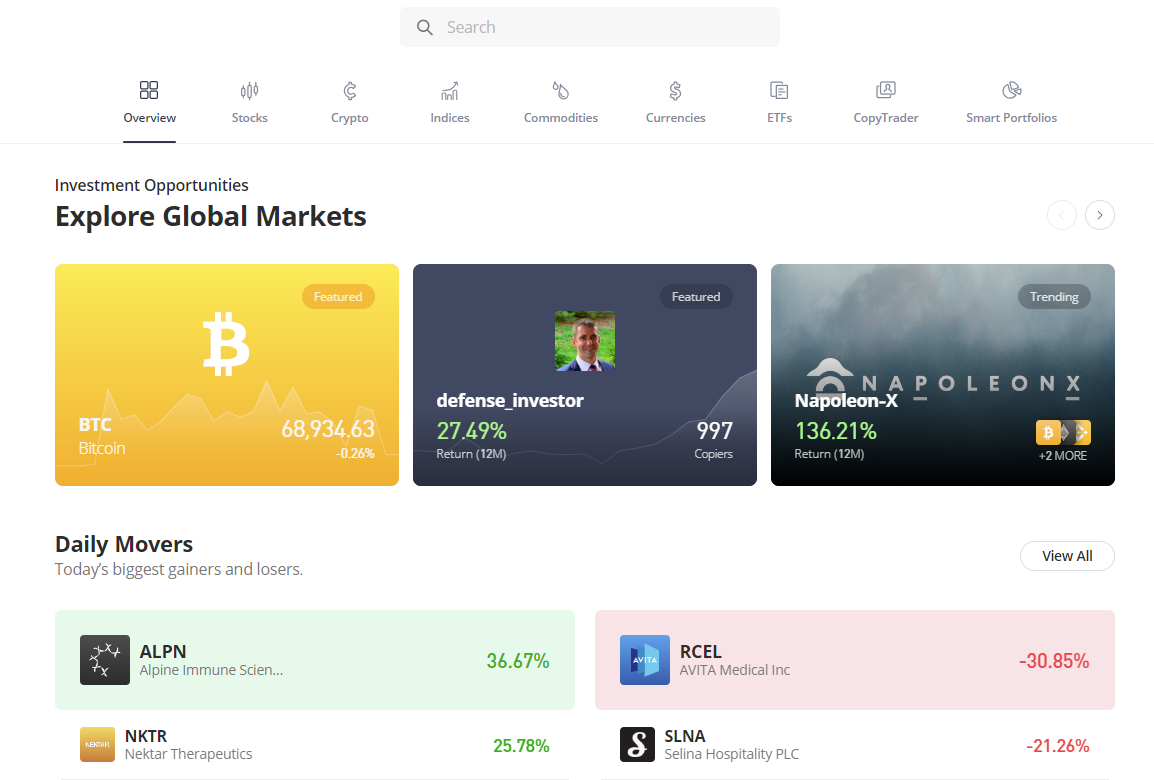

- eToro: Stands out as a leading social trading platform, enabling users to copy trades of experienced investors.

- XTB: Distinguished by its award-winning trading platform, xStation 5, and extensive educational resources.

- Libertex: Offers a commission-based model for trading, with a user-centric platform for forex and CFD trading.

- Pepperstone: Specializes in fast execution and safety, offering a wide selection of trading instruments and integration with MetaTrader and cTrader.

- Capital.com: Focuses on technological innovation and offers a wide range of CFD trading options with an AI-driven platform.

- Freedom24: Unique for offering direct access to IPOs and pre-IPO investments, alongside a broad range of other tradable assets.

- IG: Known for its vast selection of over 18,000 financial instruments and sophisticated proprietary trading platform.

Now, we’ll explore the standout features of these top 10 online trading brokers, evaluating their trading platforms, fee structures, and overall user experiences. This detailed overview is designed to offer insights into what makes each broker unique. We aim to simplify your search for the ideal platform that aligns with your investment strategy and financial goals.

RoboForex

RoboForex is a well-regarded broker, known for its comprehensive trading services and client-focused approach. It offers access to many financial markets like forex, stocks, indices, futures, and ETFs. The leverage offers is one of the highest in the industry with some assets having 1:2000.

RoboForex offers cutting-edge trading technology. Clients have access to MetaTrader 4 and 5, cTrader, and R Trader. These platforms come with great analytical tools, automated trading bots, and one-click trading options. The overall user experience when trading is seamless with RoboForex.

Furthermore, the features offered on RoboForex are top-notch, and all traders will find them useful. The copy trader allows users to make the same trades as professionals and capitalize on winning opportunities. Meanwhile, the tools section comes with market analysis, an economic calendar, a trading calculator, and more.

The broker has competitive spreads with low commissions and spreads. Depending on your account type, some assets will have a commission of 0%. There is no fee for depositing funds, but a withdrawal fee will apply to all payment methods. However, twice a month, the broker allows 0% commission withdrawals.

RoboForex is regulated by the Financial Services Commission (FSC) in Belize and follows the international anti-money laundering policy. This ensures users are safe to trade on the platform as the broker’s services are thoroughly checked.

| Feature | Details |

|---|---|

| Tradable Assets | Stocks, forex, ETFs, commodities, indices, futures |

| Number of Assets | Over 12,000 |

| Fees & Commissions | Spreads and commissions depend on the type of asset |

| Platforms | MetaTrader 4, MetaTrader 5, cTrader, R Trader |

| Customer Service | Live chat, email, phone, |

| Demo Account | Yes |

| Regulation | FSC |

FP Markets

FP Markets excels in offering a rich trading environment, focusing on forex and CFDs. The asset types they offer are forex, stocks, indices, commodities, and digital currencies. A standout feature of FP Markets is its trading platform offerings: MetaTrader 4, MetaTrader 5, Iress, and WebTrader. It also comes with a Forex calculator that is helpful for determining the profitability of potential trades.

However, if you’re new to forex and plan to use MetaTrader 4 but lack the necessary knowledge, FP Markets has you covered. It has a dedicated section called the “Meta Trader (MT4) Traders Toolbox”, which offers advanced guides on using the platform. It contains videos on using the software and a detailed tutorial with pictures to make it easier to understand.

Pricing at FP Markets is competitive, with tight spreads that can start from 0.0 pips and low commission rates for forex trading, making it an attractive proposition for active traders who value cost efficiency.

Customer support is a priority, with a dedicated team available 24/5 through various channels, ready to assist with any queries or issues, ensuring a smooth trading experience. If you’re unable to find the information you need, FP Markets offers a callback service where a customer support member will call you as soon as possible.

FP Markets complies with regulations holding licenses from ASIC, CySEC, FSCA, FSA, and FSC. This regulatory oversight affirms FP Markets’ dedication to upholding high standards of security and ethical trading practices.

| Feature | Details |

|---|---|

| Tradable Assets | Forex, indices, commodities, ETFs, stocks, cryptocurrencies |

| Number of Assets | Over 10,000 |

| Fees & Commissions | 0% commission, but spreads will apply |

| Platforms | MetaTrader 4, MetaTrader 5, Iress, WebTrader |

| Customer Service | Live chat, email, phone, FAQ Section |

| Demo Account | Yes |

| Regulation | CySEC, ASIC |

Vantage Markets

Vantage Markets offers a direct approach to online trading with a focus on forex, indices, commodities, CFDs on stocks, and cryptocurrencies. The broker facilitates access to major markets, enabling traders to diversify their portfolios across various asset classes. Users have access to MetaTrader 4 and MetaTrader 5 platforms for a reliable trading experience, alongside a proprietary mobile app for trading on the move.

In terms of costs, Vantage Markets maintains a competitive position with tight spreads and low commission rates aimed at enhancing traders’ profitability. The platform has a page that discloses the spreads or commissions for each asset class.

Also, the broker supports its clients with a range of educational resources to help traders expand their knowledge. Users can take courses that provide in-depth information, helpful for those starting their trading career. The webinar page features a calendar, making it easy to prepare for the next event and join live. These webinars are led by professionals and teach how to utilize specific technical indicators and other trading-related subjects.

Vantage Markets is regulated by multiple authorities, such as ASIC, FSCA, and FCA. The broker employs SSL (Secure Socket Layer) encryption across its platforms to safeguard data transmissions. Additionally, client funds are held in segregated accounts with top-tier banks, ensuring that traders’ capital is kept separate from the company’s operating funds.

Furthermore, customer support is very helpful, offering assistance through live chat, email, and phone to address any queries quickly. This combination of market access, user-friendly platforms, clear pricing, educational support, and regulatory compliance makes Vantage Markets a solid choice for traders looking for a straightforward and effective trading experience.

| Feature | Details |

|---|---|

| Tradable Assets | Forex, indices, commodities, ETFs, bonds, stocks, cryptocurrencies |

| Number of Assets | Over 1,000 |

| Fees & Commissions | Commission depends on the type of asset and currency |

| Platforms | MetaTrader 4, MetaTrader 5, proprietary mobile app |

| Customer Service | Live chat, email, FAQ section |

| Demo Account | Yes |

| Regulation | FCA, ASIC, CIMA |

eToro

eToro is our top choice because it has differentiated itself as a leading social trading platform, offering users a unique way to engage with financial markets. At its core, eToro enables trading in a wide variety of assets, including stocks, forex, cryptocurrencies, ETFs, and commodities.

This diverse range of tradable assets makes it a versatile choice for investors looking to expand or diversify their portfolios. The platform’s social trading feature, which allows users to copy the trades of experienced investors, further enhances its appeal, especially to beginners seeking guidance in navigating the markets.

When it comes to fees and commissions, eToro maintains a transparent and competitive structure. While stock and ETF trading are commission-free, other assets like forex and cryptocurrencies are subject to spreads, which are detailed on eToro’s website. Additionally, a nominal withdrawal fee and overnight or weekend fees for CFD positions may apply.

eToro’s Beginner-Friendly Platform, Customer Service, and Regulations

eToro’s platform is designed for ease of use without sacrificing depth and functionality. Available on both web and mobile applications, it ensures that users can access their accounts and execute trades from anywhere at any time. The interface is intuitive, catering to beginners, yet it offers advanced tools and charts that more experienced traders look for. Furthermore, eToro’s commitment to innovation means it regularly updates its platform features to enhance user experience and meet the evolving needs of its clientele.

Customer service and security are excellent at eToro. Users can reach customer support through live chat, email, and a comprehensive FAQ section that addresses a wide range of issues.

On the security front, eToro adheres to strict regulations, being licensed by several financial authorities, including CySEC in Cyprus, FCA in the UK, and ASIC in Australia. This regulatory oversight assures users of the platform’s reliability and the safety of their funds. eToro employs advanced security measures, including SSL encryption, to protect personal information and transactions, underscoring its commitment to providing a secure trading environment.

| Feature | Details |

|---|---|

| Tradable Assets | Stocks, forex, cryptocurrencies, ETFs, commodities, indices |

| Number of Assets | Over 5,000 |

| Fees & Commissions | No commission, but it applies a spread on certain assets. 1% trade fee for crypto. |

| Platforms | eToro trading platform |

| Customer Service | Live chat, email, phone, FAQ section |

| Demo Account | Yes |

| Regulation | CySEC, FCA, ASIC, and FinCEN |

XTB

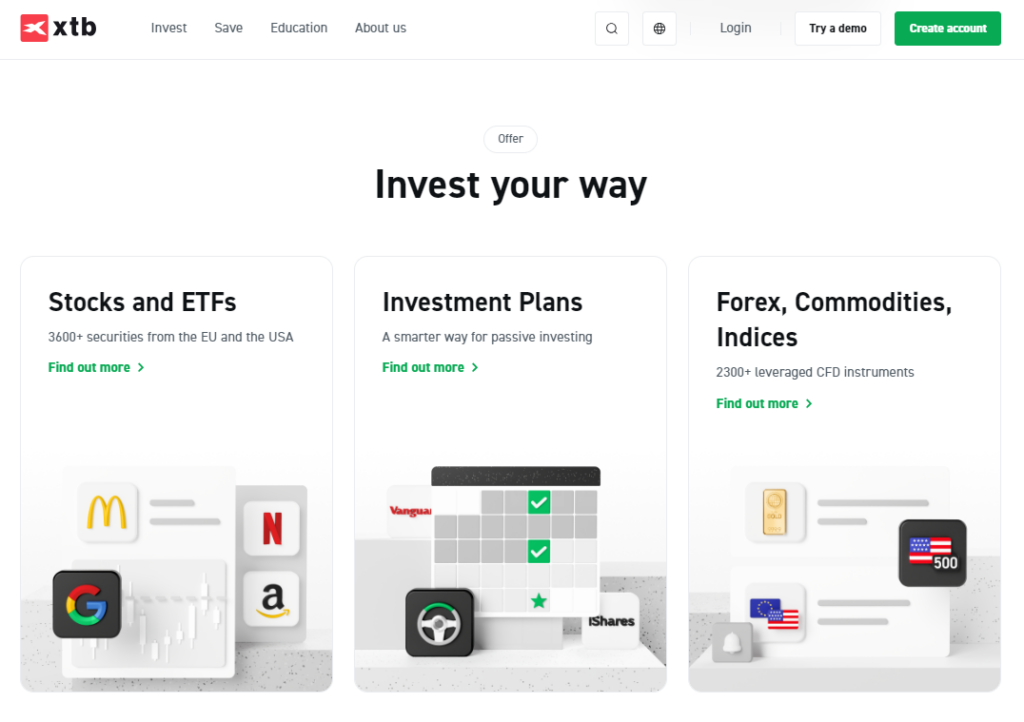

XTB sets itself apart by providing a superior trading environment and extensive educational resources, making it an attractive platform for traders at all levels. As a global leader in FX and CFD trading, XTB offers a broad range of markets such as forex, indices, commodities, stock CFDs, ETFs, ETF CFDs, and cryptocurrencies. This diversity ensures that traders have ample opportunities to diversify their portfolios and engage with a wide variety of asset classes.

One of XTB’s standout features is its award-winning trading platform, xStation 5, which combines functionality with user-friendly design. The platform has superior execution speeds, real-time market data, advanced charting tools, and a comprehensive trading calculator. This makes it easy for traders to analyze the market, execute trades efficiently, and manage their portfolios effectively. The platform’s accessibility is further enhanced through mobile and tablet apps, enabling traders to stay connected to the markets on the go.

XTB understands the importance of cost transparency in building long-term relationships with its clients. Therefore, the broker operates with a clear fee structure, which can be found in their FAQ section. Forex and commodities trading offers competitive spreads; stock and ETF CFDs provide both commission-based and spread-only trading options.

Additionally, XTB supports its traders through a no-minimum deposit policy and offers free educational resources, including webinars, trading courses, and articles, to empower traders with the knowledge to succeed.

Moreover, XTB places a high priority on customer service, offering 24/5 support via phone, email, and live chat. This dedication to providing comprehensive support and maintaining a secure trading platform demonstrates XTB’s commitment to its clients’ trading success.

Security and regulation are at the forefront of XTB’s operations, underpinning its credibility as a trusted broker. Regulated by several authorities, including the UK’s Financial Conduct Authority (FCA) and Poland’s KNF, traders can feel secure in the knowledge that they are trading with a broker that adheres to strict regulatory standards. One of their security measures is the segregation of clients’ funds, meaning your investment is safe in the event the broker goes bankrupt or other related issues.

| Feature | Details |

|---|---|

| Tradable Assets | Forex, indices, commodities, stock CFDs, ETFs, ETF CFDs, cryptocurrencies |

| Number of Assets | Over 5,800 |

| Fees & Commissions | 0% commission, but spreads will apply |

| Platforms | xStation 5 |

| Customer Service | Live chat, email, FAQ section |

| Demo Account | Yes |

| Regulation | FCA, KNF, CySEC |

Libertex

Libertex, a reputable online broker with over two decades of experience, specializes in forex and CFD trading. It presents traders with the opportunity to engage with a multitude of financial markets, including but not limited to, an extensive range of currency pairs, blue-chip stocks, key indices, precious metals, energy commodities, and the evolving sector of cryptocurrencies.

Distinctively, Libertex adopts a commission-based model rather than relying on spreads, setting it apart from many competitors. This pricing strategy enhances cost transparency, enabling traders to understand the precise charges applied to their trades upfront. Such clarity is beneficial, particularly for strategic planning and managing trading costs effectively.

The Libertex platform, recognized for its user-centric design, facilitates a seamless trading experience. It incorporates advanced financial analysis tools, risk management features like stop loss and take profit orders, and the convenience of one-click trading, all within an interface that balances simplicity with functionality. Traders have the option to use the Libertex award-winning platform, MetaTrader 4, or MetaTrader 5.

Libertex operates under strict regulatory oversight by the Cyprus Securities and Exchange Commission (CySEC), affirming its commitment to upholding high standards of integrity and client security. This regulatory foundation is pivotal, ensuring that Libertex adheres to stringent operational guidelines, which include the protection of client funds through segregated accounts and the encryption of personal data to safeguard client information.

The educational section is outstanding and helpful for those new to trading. Beginners can learn the basics for free through the 9 lesson program. Also, there is an analytical section that focuses on current events and how they can impact prices.

Customer support is unlike other platforms, as Libertex has a dedicated knowledge base containing a lot of information. Here, users can utilize the search bar to find any information they need. There is a contact us button if the database does not contain the answer the trader is looking for. Also, live chat is available for quick inquiries.

| Feature | Details |

|---|---|

| Tradable Assets | Forex, indices, commodities, ETFs, options, bonds, stocks, cryptocurrencies |

| Number of Assets | Over 300 |

| Fees & Commissions | Commission and spreads depend on the type of asset and currency |

| Platforms | Libertex platform, MetaTrader 4, MetaTrader 5 |

| Customer Service | Live chat, email, phone, FAQ Knowledge Base |

| Demo Account | Yes |

| Regulation | CySEC |

Pepperstone

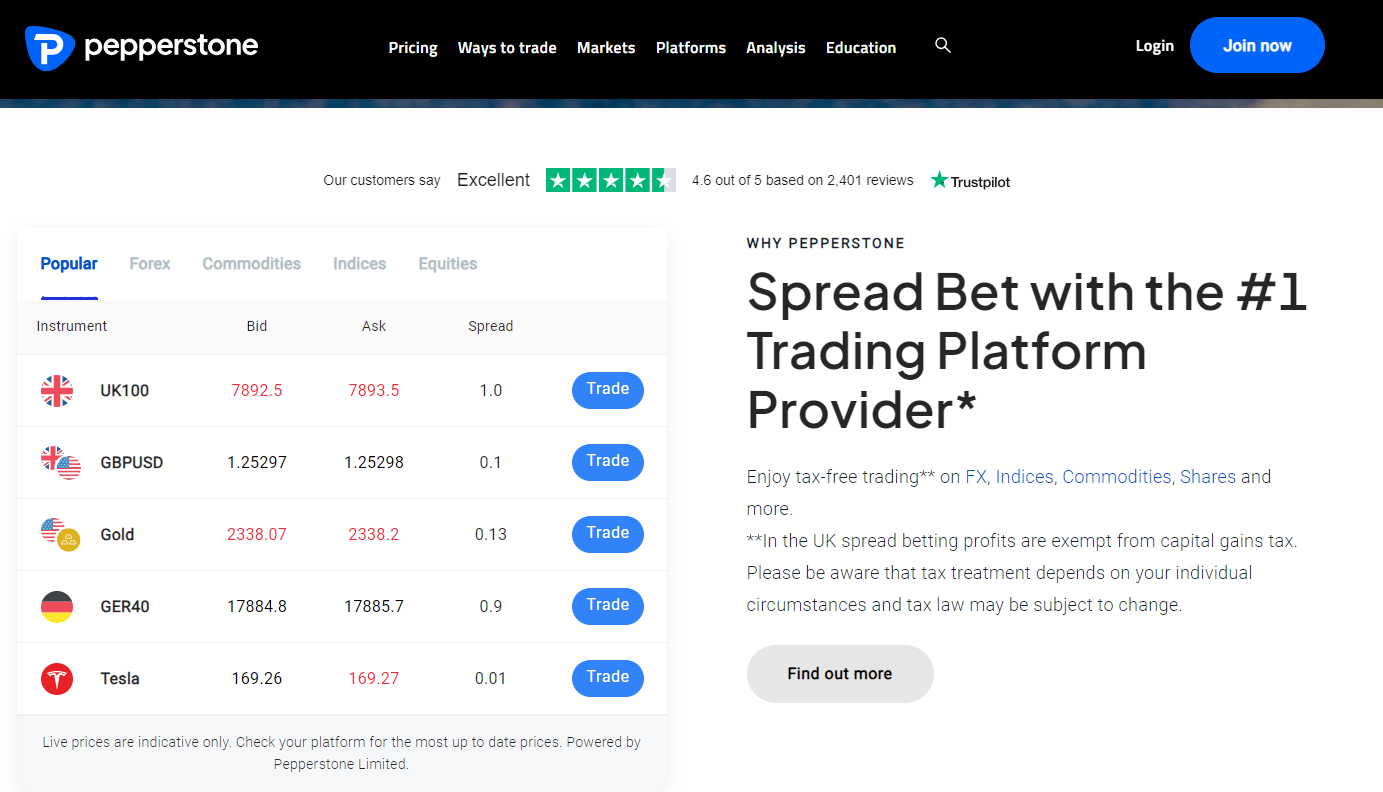

Pepperstone, a global online broker, specializes in trading forex, and CFDs on indices, commodities, stocks, and cryptocurrencies, appealing particularly to traders who prioritize fast execution, safety, and a wide selection of trading instruments. Pepperstone is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK.

These regulations ensure that Pepperstone adheres to stringent standards for operational excellence and transparency. They also segregate client funds and distribute the money across multiple European banks.

This broker is well-regarded for integrating reliable and flexible trading platforms such as MetaTrader 4 and MetaTrader 5, along with cTrader, each offering unique features like advanced charting tools, automated trading capabilities through Expert Advisors (EAs) on MetaTrader platforms, and a customizable trading interface on cTrader.

These platforms cater to the needs of both novice traders and experienced professionals by providing an optimal trading environment that enhances decision-making and strategy implementation. Also, they offer demo accounts so you can test the software and broker before committing money.

Pricing at Pepperstone is designed to be transparent and competitive, featuring some of the industry’s lowest spreads. The platform does not charge a commission but adds a spread to make profits. Before signing up, you can take a look at Pepperstones fees for each trading instrument on their spreads page.

Furthermore, Pepperstone does not compromise on the quality of service, offering robust educational resources such as trading guides, webinars hosted by market experts, and daily market analysis to empower traders with the knowledge to navigate the markets confidently. Also, the analysis section is insightful and discloses current trends in the market. This section showcases who is doing the analysis, letting traders view their background, ensuring they are a trustworthy source of information.

At the top of Pepperstone’s website, you’ll find the help and support section. This will lead you to an extensive FAQ section that answers traders’ common inquiries. However, if you need more information, the contact section at the bottom of this page lets you get in touch via phone or email.

| Feature | Details |

|---|---|

| Tradable Assets | Forex, indices, commodities, ETFs, stocks, cryptocurrencies |

| Number of Assets | Over 1,200 |

| Fees & Commissions | Commission and spreads depend on the type of asset and currency |

| Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Customer Service | Live chat, email, phone, FAQ section |

| Demo Account | Yes |

| Regulation | CySEC, FCA |

Capital.com

Capital.com focuses on technological innovation and a comprehensive selection of CFD trading options. It allows traders to engage in various markets, from forex and stocks to indices, commodities, and a particularly extensive range of cryptocurrencies.

At the core of Capital.com’s offering is its sophisticated, proprietary trading platform, engineered for accessibility and efficiency. It features advanced charting tools, risk management options, and an AI-driven system that offers financial insights into individual trading patterns, enhancing decision-making processes.

Capital.com is noted for its clear, competitive fee structure, eliminating commissions on trades and offering narrow spreads across its product range. This approach extends to its policy of no charges for deposits, withdrawals, or account maintenance, setting a standard for transparent, cost-effective trading.

Emphasizing security and compliance, Capital.com operates under the strict regulations of the SCB, FCA, and CySEC, ensuring a high level of trust and safety for traders’ funds. The platform also uses encryption and two-factor authentication to secure your account.

The educational tab is the best in the industry, which is why we have incorporated it into our list. This section teaches beginners the basics of trading and offers multiple courses on different subjects. There are also courses for experienced traders who are looking to expand their knowledge and learn new strategies.

Capital.com is the ideal platform for staying on top of market trends because of the news and analysis section. Blogs are posted almost daily and offer great insights into markets. Also, you can prepare for upcoming events by looking at the economic calendar, which shows important financial information for each country.

Furthermore, customer support on Capital.com is ultra-responsive, and you can contact the broker through multiple methods such as email, phone, live chat, or submit a request. For simple inquiries, the support center contains a lot of information about the broker and how to use its services.

| Feature | Details |

|---|---|

| Tradable Assets | Forex, indices, commodities, ETFs, stocks, cryptocurrencies |

| Number of Assets | Over 3,000 |

| Fees & Commissions | 0% commission, but spreads will apply |

| Platforms | TradingView, MetaTrader 4 |

| Customer Service | Live chat, email, phone, FAQ Section |

| Demo Account | Yes |

| Regulation | CySEC, FCA, SCB |

Freedom24

Freedom24 by Freedom Finance Europe Ltd. breaks the mold of traditional online brokers by offering an innovative pathway to the stock market, particularly highlighting its unique access to IPOs and pre-IPO investments, making it the second choice on our list. This standout feature allows individual investors to partake in initial public offerings before they hit major exchanges, presenting a rare opportunity for lucrative returns.

However, the platform doesn’t stop there; it extends its portfolio offerings to include multiple tradable assets such as stocks, ETFs, options, and bonds across U.S. and European markets, ensuring traders have a wealth of investment opportunities at their fingertips.

The platform itself is engineered for user engagement and ease, supporting traders through every step of their investment journey. Whether accessing the market via the web or the mobile app, users are greeted with an intuitive interface designed to streamline the trading process.

Beyond trading, Freedom24 is packed with analytical tools and real-time data feeds, complemented by personalized news updates to keep traders informed and ready to act on market movements. This focus on providing a comprehensive trading experience is further enhanced by the broker’s commitment to education, offering an array of webinars, tutorials, and in-depth market analysis.

Freedom24 offers commission-free trades for U.S. stocks. However, engaging in European markets, options trading, and ETF investments incur specific fees. The platform’s pricing model is clearly outlined, ensuring traders can make informed decisions without worrying about hidden costs. Users can pick a free plan for USD and EUR; based on this, traders receive specific costs for placing orders.

Freedom24 prioritizes the security and satisfaction of its clients. Adhering to stringent regulations set forth by the Cyprus Securities and Exchange Commission (CySEC), the platform assures a regulated trading environment. Coupled with robust security protocols such as SSL encryption and two-factor authentication, traders can operate with confidence, knowing their data and investments are safeguarded.

Customer support further elevates the trading experience, offering multiple channels for assistance ensuring that every query, from platform navigation to complex trading inquiries, is addressed promptly and efficiently.

| Feature | Details |

|---|---|

| Tradable Assets | Stocks, ETFs, options, bonds across U.S., and European markets |

| Number of Assets | Over 1,000,000 |

| Fees & Commissions | Depends on plan and type of asset |

| Platforms | Freedom24 trading platform |

| Customer Service | Live chat, email, FAQ section |

| Demo Account | Yes |

| Regulation | CySEC |

IG

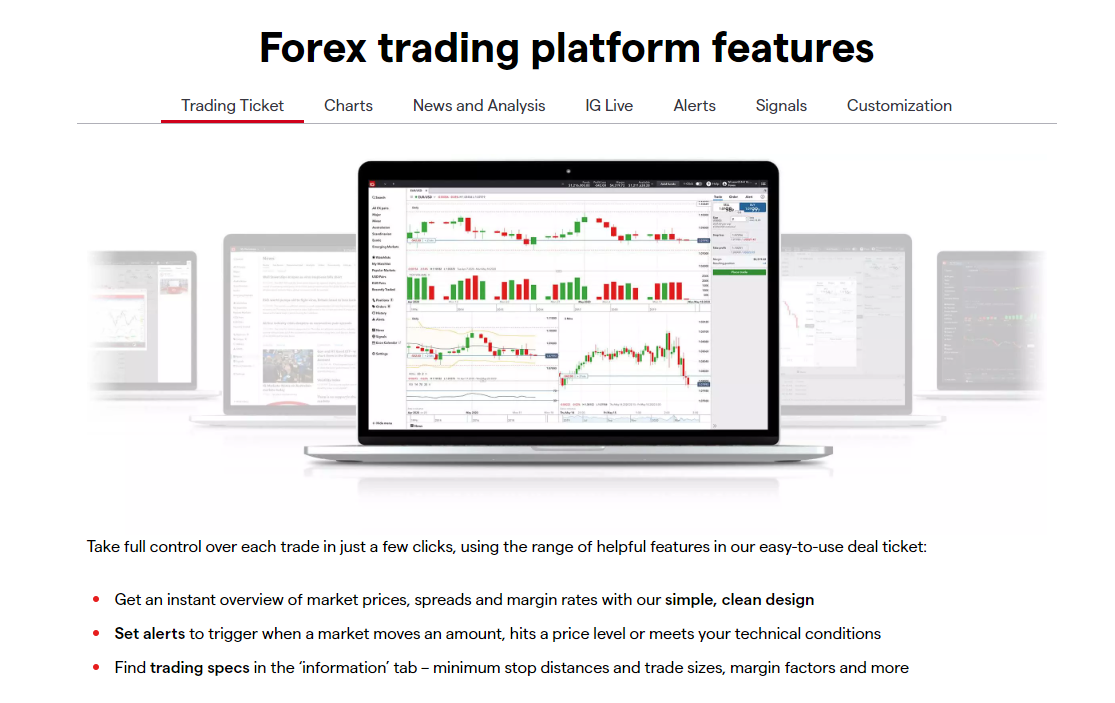

IG sets a high standard in the online brokerage industry with its extensive market access, boasting over 18,000 financial instruments, including forex pairs, global stocks, indices, commodities, and an increasing selection of cryptocurrencies. This vast offering enables traders to explore and invest in markets across the globe, all from a single platform.

IG’s commitment to technology and user experience is evident in its proprietary platform, which is engineered for speed and efficiency, offering advanced charting tools, risk management features, and seamless execution.

For traders who prefer a widely used interface, IG also provides access to MetaTrader 4, which is popular for its customizable charts and supportive community. Unique to IG, however, is its Direct Market Access (DMA) facility, allowing sophisticated traders to place orders directly into the order books of global stock exchanges, providing transparency and flexibility in trading execution, particularly for high-volume equity and forex transactions.

In terms of costs, IG maintains a transparent approach. The broker offers competitive spreads starting from 0.6 pips on major forex pairs and applies a commission for trading shares. This clarity in pricing, combined with no hidden fees policy, empowers traders to manage their investments without unexpected costs.

Furthermore, IG supports its clients’ growth and learning through an expansive selection of educational materials, including detailed trading guides, webinars led by industry experts, and an active trading community for peer support.

Regulated by multiple financial authorities globally, including the Financial Conduct Authority (FCA) in the UK, IG prioritizes the security of client funds and information. This regulatory oversight assures traders of IG’s adherence to strict financial standards and ethical trading practices.

Alongside robust security measures, IG’s customer service stands out for its comprehensiveness, offering 24/7 support through various channels to ensure traders can resolve issues and get answers to their questions at any time.

| Feature | Details |

|---|---|

| Tradable Assets | Forex, indices, commodities, ETFs, stocks, cryptocurrencies |

| Number of Assets | Over 18,000 |

| Fees & Commissions | 0% commission, but spreads will apply |

| Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Customer Service | Live chat, email, phone, FAQ section |

| Demo Account | Yes |

| Regulation | CySEC, FCA |

Comparison: The best 10 Brokers

| Broker | Tradable Assets | Number of Assets | Fees & Commissions | Platforms | Customer Service | Demo Account | Regulatoin |

|---|---|---|---|---|---|---|---|

| RoboForex | Stocks, forex, ETFs, commodities, indices, futures | Over 12,000 | Commission and spreads depend on asset | MetaTrader 4, MetaTrader 5, cTrader, R Trader | Live chat, email, phone | Yes | FSC |

| FP Markets | Forex, indices, commodities, ETFs, stocks, cryptocurrencies | Over 10,000 | 0% commission, but spreads will apply | MetaTrader 4, MetaTrader 5, Iress, WebTrader | Live chat, email, phone, FAQ Section | Yes | CySEC, ASIC |

| Vantage Markets | Forex, indices, commodities, ETFs, bonds, stocks, cryptocurrencies | Over 1,000 | Commission depends on asset and currency | MetaTrader 4, MetaTrader 5, proprietary mobile app | Live chat, email, FAQ section | Yes | FCA, ASIC, CIMA |

| eToro | Stocks, forex, cryptocurrencies, ETFs, commodities, indices | Over 5,000 | No commission, but it applies a spread on certain assets, 1% trade fee for crypto | eToro trading platform | Live chat, email, phone, FAQ section | Yes | CySEC, FCA, ASIC, and FinCEN |

| XTB | Forex, indices, commodities, stock CFDs, ETFs, ETF CFDs, cryptocurrencies | Over 5,800 | 0% commission, but spreads will apply | xStation 5 | Live chat, email, FAQ section | Yes | FCA, KNF, CySEC |

| Libertex | Forex, indices, commodities, ETFs, options, bonds, stocks, cryptocurrencies | Over 300 | Commission and spreads depend on asset and currency | Libertex platform, MetaTrader 4, MetaTrader 5 | Live chat, email, phone, FAQ Knowledge Base | Yes | CySEC |

| Pepperstone | Forex, indices, commodities, ETFs, stocks, cryptocurrencies | Over 1,200 | Commission and spreads depend on asset and currency | MetaTrader 4, MetaTrader 5, cTrader | Live chat, email, phone, FAQ section | Yes | CySEC, FCA |

| Capital.com | Forex, indices, commodities, ETFs, stocks, cryptocurrencies | Over 3,000 | 0% commission, but spreads will apply | TradingView, MetaTrader 4 | Live chat, email, phone, FAQ Section | Yes | CySEC, FCA, SCB |

| Freedom24 | Stocks, ETFs, options, bonds across U.S., and European markets | Over 1,000,000 | Depends on plan and type of asset | Freedom24 trading platform | Live chat, email, FAQ section | Yes | CySEC |

| IG | Forex, indices, commodities, ETFs, stocks, cryptocurrencies | Over 18,000 | 0% commission, but spreads will apply | MetaTrader 4, MetaTrader 5, cTrader | Live chat, email, phone, FAQ section | Yes | CySEC, FCA |

How We Select the Best Online Broker and How Do You Find One

Selecting the best online broker involves examining several crucial factors that impact a trader’s experience and success. Our comprehensive review process on Witzel Trading and the criteria we suggest you use are designed to pinpoint platforms that offer a balance of reliability, affordability, and user-friendly features. Here’s a detailed look at the key factors we considered and how you can apply these criteria to find the best online broker for your trading needs.

Regulation

The cornerstone of a trustworthy online broker is its adherence to regulatory standards. Regulation by a reputable authority is not just a badge of legitimacy; it’s a crucial layer of protection for traders. Regulated brokers are required to maintain high standards of conduct, ensure transparency in their operations, and provide a degree of financial security to their clients.

For instance, brokers regulated by entities like the US Securities and Exchange Commission (SEC), the Financial Conduct Authority (FCA), or the Cyprus Securities and Exchange Commission (CySEC) are held to rigorous standards that safeguard traders’ interests.

Regulatory compliance also ensures brokers operate with a level of integrity and reliability. This includes the segregation of client funds from the broker’s operational funds, participation in compensation schemes that protect investors’ funds up to a certain amount, and adherence to fair trading practices.

In our selection process, the regulatory status of a broker was a primary factor. We carefully examined the licenses held by each broker, their history of compliance with regulatory requirements, and their transparency in communication with clients. For traders looking for a broker, we recommend starting with the regulatory status. Verify their licenses, understand the protections offered under their regulatory framework, and consider the jurisdiction’s reputation for financial oversight.

However, regulation alone isn’t the only criterion for selecting a broker, but it provides a solid foundation for evaluating a broker’s credibility and the security of your investments.

Advantages of On-Shore Brokers

Choosing an on-shore broker, regulated within well-established financial markets such as the United States, the European Union, or the United Kingdom comes with several inherent benefits that will significantly impact your trading experience. These brokers ensure a higher standard of transparency and accountability in their operations due to the stringent regulatory oversight.

The protection schemes, as mentioned previously, protect investors in case of broker insolvency or other issues. This aspect alone makes on-shore brokers a preferred choice for those who prioritize the safety of their investments.

Moreover, on-shore brokers provide access to major financial markets and a wide array of trading instruments, from stocks and bonds to complex derivatives. This access helps traders diversify their portfolios across various asset classes.

The technological infrastructure and customer services offered by on-shore brokers are often superior, thanks to the competitive and regulatory standards they must adhere to. This can translate into more advanced trading platforms, comprehensive educational resources, and responsive customer support, all of which are critical components for successful trading.

Advantages of Off-Shore Brokers

Off-shore brokers, operating outside the stringent regulatory frameworks of major financial markets, present a distinct set of advantages for traders seeking alternative investment opportunities and conditions. These brokers are often favored for their ability to offer enhanced flexibility in trading practices, potentially lower fees, and access to a broader range of financial markets and instruments not always available through on-shore brokers.

One significant benefit of using off-shore brokers is their ability to provide higher leverage options. This can be a double-edged sword, as while it allows for the amplification of returns, it also increases risk exposure. However, for experienced traders with robust risk management strategies, this can present an opportunity to capitalize on market movements more aggressively compared to an on-shore broker.

Additionally, off-shore brokers may offer more competitive pricing structures like lower commission rates and tighter spreads, as they are not subject to the same level of operational and regulatory costs as their on-shore counterparts. This can be advantageous for traders who operate with high volume, where even slight differences in transaction costs can have a significant impact on net returns.

Another appealing aspect of off-shore brokers is they are typically less restrictive with account registration and verification processes. This can facilitate quicker access to trading platforms and services, allowing traders to take advantage of market opportunities without delays.

Security and Trustworthiness

Ensuring the security and trustworthiness of an online broker is a critical aspect to consider because it’s not just about the safety of financial assets but also the protection of personal and sensitive data. In this digital age, cyber threats are increasingly sophisticated, and the mechanisms along with protocols a broker employs to safeguard clients are indicators of their reliability and professionalism. Here’s how a broker protects their users:

- SSL/TLS Encryption: This encryption technology makes it safe to use brokers and transfer information like identification documents and other personal information. It makes intercepting and understanding information difficult.

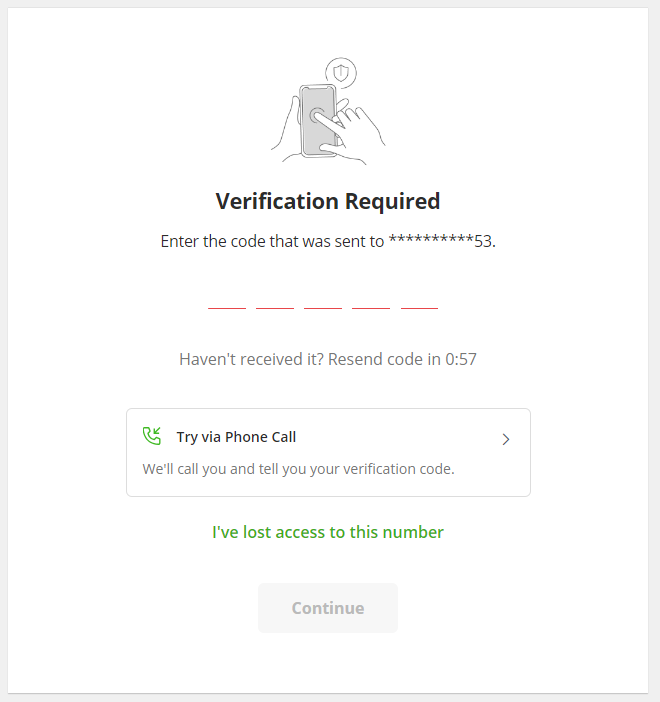

- Two-Factor Authentication (2FA): An additional security step requiring users to verify their identity when signing in by getting a code from their email, phone, or authentication app. This significantly reduces the risk of unauthorized account access.

- Regular Independent Audits: These are assessments conducted by external third-party organizations that evaluate the broker’s compliance with financial regulations, security standards, and operational integrity. These audits help ensure the broker is following the best practices in protecting clients as a result providing trustworthiness to users.

- Data Privacy Policies: These policies outline how a broker collects, uses, stores, and protects clients’ personal information. Reading this outlines how transparent the broker is about its data handling practices and how committed they are to protecting user privacy.

- Automatic Logout Mechanisms: This feature automatically logs users out of their accounts after a period of inactivity. It helps prevent unauthorized access by ensuring that open sessions are not left unattended for extended periods.

- Continuous Monitoring and Alerts: Brokers employ systems to continuously monitor accounts for suspicious activity, such as unusual login attempts or strange trading patterns. Users are immediately alerted to any suspicious activity for verification, helping prevent unauthorized access and fraud.

- Client Fund Segregation: This requires keeping clients’ money in separate bank accounts from the broker’s operational funds. It ensures client money is not used for the company’s day-to-day operations and provides a layer of protection in case the company faces financial difficulties.

- Secure Payment Processing: Brokers will offer trusted and secure methods for processing deposits and withdrawals to protect users from fraud. This might include the use of encrypted payment gateways and partnerships with reputable financial institutions.

- User Access Controls: This allows users to customize their security settings within their account, like setting up permissions for different types of transactions and controlling which devices can access their account. It offers users a more personalized and secure trading experience.

Range of Financial Products

When looking at the range of financial products offered by online brokers, it’s important to know the diversity and accessibility of investment options available to traders. This diversity is not just about offering a broad spectrum of assets but providing traders with the tools and opportunities to diversify their portfolios, manage risks, and capitalize on market opportunities. A broker that offers multiple financial products demonstrates its capacity to serve a diverse clientele, from novice traders to experienced investors looking for complex investment vehicles.

The importance of a broad product range lies in its ability to cater to the varied investment preferences and risk tolerances of traders. Whether a trader is focused on long-term growth through diversified ETF portfolios or on capitalizing on short-term market movements through leveraged CFD trading, a broker’s product range can significantly impact the execution of investment strategies. Here are the main types of investment instruments offered:

- Stocks: Ownership stakes in publicly traded companies. Investing in stocks offers the potential for capital appreciation and dividends. Investors can choose from different market sectors, enabling portfolio diversification.

- Bonds: Debt investments whereby an investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period at a fixed interest rate. Bonds are used for income generation and for risk diversification.

- ETFs (Exchange-Traded Fund): Investment funds traded on stock exchanges, similar to stocks. ETFs hold assets such as stocks, commodities, or bonds and generally operate with an arbitrage mechanism designed to keep trading close to its net asset value, though deviations can occasionally occur.

- Commodities: Physical goods like gold, oil, and agricultural products that are traded on commodities exchanges. Commodities can serve as a hedge against inflation and currency depreciation.

- Forex: The trading of currency pairs in the foreign exchange market, which is the largest financial market globally. Forex trading involves the simultaneous buying of one currency and selling it for another.

- Options: Contacts offering the buyer the right to buy (call option) or sell (put option) the underlying asset at a specified strike price until the expiration date. Options are used for hedging, income generation, or speculation on the direction of an asset’s price.

- Futures: These are standardized contracts to buy or sell a specific asset at a predetermined price at a specified time in the future. Futures are used for hedging against price movements or for speculative purposes.

- CFDs (Contract for Difference): A type of derivative trading that allows investors to speculate on rising or falling prices of fast-moving global financial markets (or instruments) such as shares, indices, commodities, currencies, and treasuries.

- Cryptocurrencies: Digital currencies like Bitcoin and Ethereum have emerged as alternative investments, offering significant returns but come with higher volatility and risk.

- Indices: Indices measure the price performance of a group of shares from an exchange. For example, the S&P 500 follows the top 500 companies in the United States. This allows investors to quickly buy into this market sector rather than buying and managing each stock individually.

Demo Account and Account Plans

We’ve focused on brokers that offer demo accounts because they allow traders to develop their risk-free skills. Demo accounts allow traders to experience the platform’s features, test trading strategies, and get accustomed to the market’s volatility without risking real money. This simulated environment is invaluable for beginners who are just starting out, providing a safe space to learn and practice.

Account plans, on the other hand, cater to the diverse needs and preferences of the trading community. From basic accounts suitable for newcomers with lower minimum deposits and essential features to more advanced accounts offering lower spreads, higher leverage, or additional tools for experienced traders.

Moreover, account plans can significantly impact a trader’s cost-benefit analysis. For instance, premium accounts might offer free access to advanced analytical tools or waived withdrawal fees, which can be advantageous for high-volume traders. The availability of different account types ensures traders can select a plan that best fits their trading style, financial goals, and level of expertise.

Compatible Trading Platforms

Choosing the right trading platform is a critical decision for traders of all levels. A platform’s usability, speed, and features directly influence trading efficiency and effectiveness. Beginners need platforms that are intuitive and easy to navigate, reducing the learning curve and allowing them to focus on developing their trading skills. Experienced traders, on the other hand, require advanced charting tools, analytical capabilities, and fast execution speeds to implement complex strategies.

The compatibility of a trading platform with various devices is equally important. In today’s trading environment, the ability to access your account and trade from anywhere, at any time, is essential. Therefore, brokers that offer platforms accessible via desktop, web, and mobile apps ensure traders can stay connected to the markets, whether they are at home, in the office, or on the move. Based on these criteria, here are some of the top trading platforms brokers offer or provide integrations:

MetaTrader (MT4)

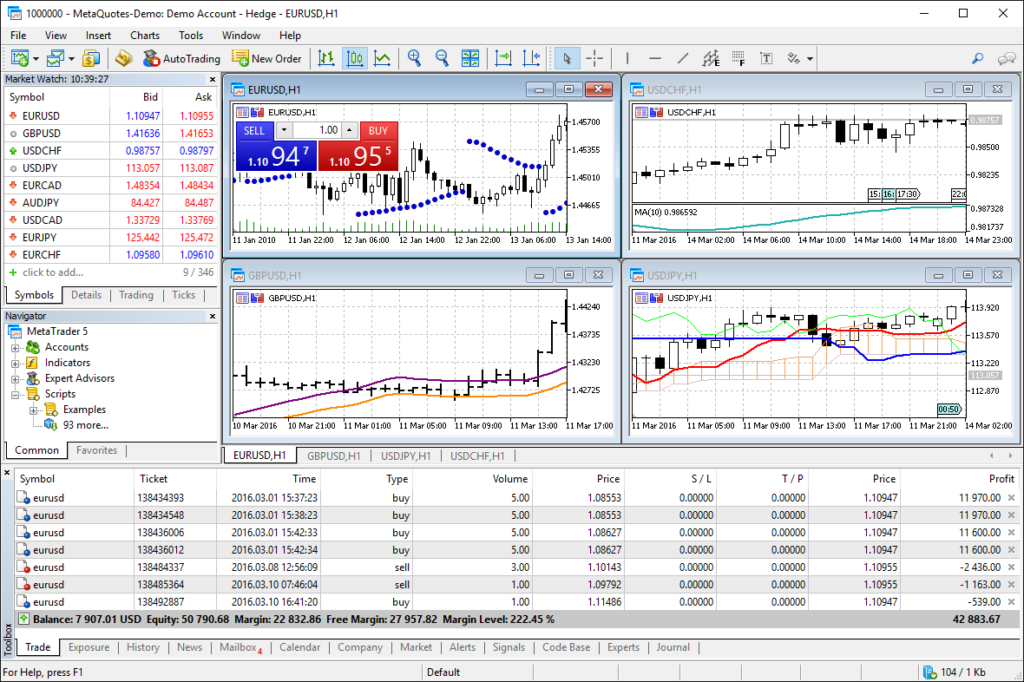

MT4 remains the gold standard for forex trading because it allows extensive customization, supports automated trading, and has an impressive selection of technical indicators. Its user interface, while rich in features, is intuitive enough for beginners yet powerful enough for expert traders.

MetaTrader 5 (MT5)

Building on the success of MT5, MetaTrader 5 introduces additional features such as more technical indicators, graphical objects, timeframes, and an economic calendar integrated directly into the platform. It expands the asset classes available to include stocks, futures, and commodities, making it a versatile choice for traders looking to diversify their portfolios.

eToro

eToro provides a simplistic user interface that is easy to use for trading. Buying and selling assets is straightforward, making it ideal for beginners.

NinjaTrader

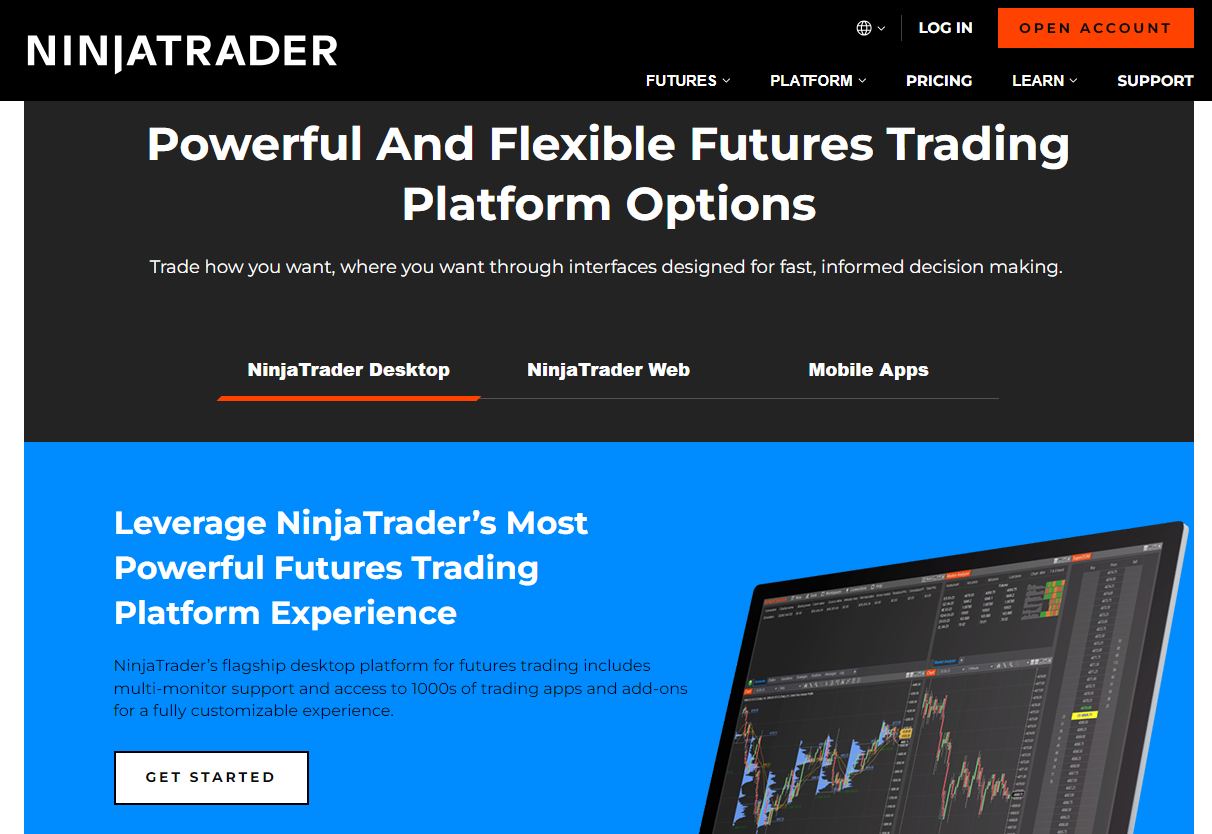

Specialized in futures and forex trading, NinjaTrader offers a powerful suite of tools designed for analyzing and executing trading strategies. It supports automated trading and backtesting with a focus on customization. NinjaTrader is ideal for traders looking for a robust platform to support complex trading strategies.

TradingView

Known for its exceptional charting tools and vibrant social networking community, TradingView supports multiple markets such as stocks, forex, futures, and cryptocurrencies. Its cloud-based platform facilitates the sharing of trading ideas and strategies, making it a favorite among traders seeking community feedback along with insights.

Order Execution

Order execution is a fundamental aspect of online trading that significantly impacts profitability. It refers to the speed and accuracy with which a broker can fill a trader’s buy or sell orders. High-quality order execution means that traders are completed fast and at the expected prices, minimizing slippage and increasing returns for the traders. This is one of the factors that impacted our decision when choosing the top 10 brokers.

Fast execution is crucial in volatile markets, where prices can change rapidly within seconds. A delay in order execution can lead to significant discrepancies between the intended and actual transaction prices, affecting the overall trading strategy’s effectiveness. Brokers with high-speed execution networks and direct access to market liquidity are better positioned to offer timely trades, which is especially important for day traders and those employing high-frequency trading strategies.

Moreover, brokers offer different order types that are effective for different strategies. Market orders and limit orders are the most commonly used types offered by brokers. Take note of what order types are provided and if they meet your criteria for joining the platform.

Fees and Commissions

The fee structure differs among brokers, but generally, most apply a trading cost along with non-trading fees. Our list of the top 10 brokers comprises the most cost-effective platforms so your profits are not diminished by fees.

These are the most common types of fees you’ll encounter:

- Trading Commissions: These are fees that brokers charge each time you execute a trade, such as buying or selling stocks. Commissions can be a flat fee per trade or based on the volume of the trade. This is a significant cost factor for active traders who execute many trades frequently.

- Spreads: The spread is the difference between the bid price and the ask price of an asset. Brokers offering no commission often use trading spreads to make their money. In highly liquid markets, spreads can be tight, but in more volatile or less liquid markets, spreads can widen, increasing the fees of the trade.

- Financing or Overnight Rates: Also known as swap rates, these are interest fees charged for holding a leveraged position overnight. The rate can be a charge on the entire position or only on the leveraged portion, varying widely between brokers and depending on the asset class.

- Account Maintenance Fees: Some brokers charge monthly or annual fees to keep your trading account open. While this practice is becoming less common, it’s still a factor to consider, especially for traders with low activity levels.

- Inactivity Fees: Aimed at encouraging trading activity, inactivity fees are charged when an account does not make any traders over a certain period. However, this fee is becoming less popular, and many of our selected brokers do not apply this cost.

- Withdrawal and Deposit Fees: These fees are incurred when adding or removing funds from your trading account. While many brokers offer free deposits, withdrawals can be high, especially for international bank transfers.

- Margin Fees: When trading on margin, brokers charge interest on the borrowed amount. The interest rate can vary based on the broker and the amount borrowed.

Customer Service

The caliber of customer service provided by an online broker is one of the key aspects we looked into because it ensures reliability and the trader’s overall satisfaction. Efficient, accessible, and knowledgeable customer support can significantly help any issues a trader may experience.

Most commonly, traders need help with account inquiries, trading problems, and clarifications on how to use services. These are the main ways to get information and help from a broker:

- Live Chat: A highly preferred support channel is live chat because it allows traders to communicate instantly with a customer service representative. It’s great for quick questions or issues that need immediate attention.

- Email Support: Ideal for detailed inquiries or when documentation needs to be submitted, email support offers a reliable way to contact customer service. While it may not provide fast help, it allows for a comprehensive exchange of information and leaves a record of communication that can be referenced later.

- Phone Support: For traders who prefer direct interaction or need to discuss complex issues, phone support provides a personal touch. It enables detailed conversations and fast feedback, which is essential for urgent problems. The availability of toll-free numbers makes this option more accessible.

- FAQs and Help Centers: FAQs can help centers contain answers to common questions, troubleshooting guides, and how-to articles. This option allows traders to find quick solutions to general issues, understand platform features, and learn more about the trading process without direct assistance.

- Social Media: Utilizing platforms like X, Facebook, and Telegram, brokers can provide timely updates, respond to trader inquiries, and engage with their client base in a public forum. This channel is becoming increasingly popular for its accessibility and the ability to offer quick assistance.

- Dedicated Account Manager: This option is usually available for premium account holders. Dedicated account managers provide personalized help, advice, and direct contact for all account-related queries. This option is valuable for serious traders seeking a higher level of support and strategic guidance.

Deposit and Withdrawal Methods

The broker must provide multiple methods of funding a trading account for convenience. Therefore, we only provided brokers that offer bank transfers, e-wallets, crypto, and other transfer methods. Having a broad range of transfer options caters to the diverse preferences and needs of traders, ensuring that they can fund their accounts and access their money with ease.

Bank transfers are a common method, preferred for their security and the ability to handle large transactions. While reliable, bank transfers can be slower than other methods and might incur high fees. Credit and debit cards offer a more immediate way to deposit funds, with transactions processed within minutes. However, withdrawal times can vary, and not all cards may be accepted.

E-Wallets like PayPal, Skrill, and Neteller provide a convenient way to transfer funds quickly and cheaply. They are becoming more popular for their ease of use and most brokers accept this payment method. Also, some platforms accept cryptocurrency transactions, appealing to traders who require anonymity.

Different Types of Online Brokers

Online brokers are classified into three types: market makers, ECN brokers, and STP/NDD brokers. Each offers different features and benefits tailored to various trading strategies. Here, we’ll outline what distinguishes each type, helping in your broker selection process.

Market Maker Broker

Market maker brokers function as intermediaries, often standing on the other side of client trades. This means they buy from or sell to clients directly, which helps ensure trades can be executed even in less active markets. By providing both bid and ask prices, they create a more controlled trading environment, usually with fixed spreads, making it easier for traders to anticipate transaction costs.

For novice traders, market maker brokers are appealing due to their straightforward platforms and the reduced minimum requirements for deposits and trades. These brokers often offer extensive educational resources, helping beginners understand trading basics and develop strategies. Additionally, the fixed spread model can simplify cost management for new traders, making budgeting for trades more predictable.

However, the market maker model can sometimes lead to conflicts of interest, as the broker profits from client losses. Recognizing this, traders must choose reputable market-maker brokers known for transparency and fair trading practices. Many regulatory bodies monitor these brokers to ensure they uphold fair trading standards, providing additional security for traders.

ECN Broker

ECN (Electronic Communication Network) brokers facilitate direct access to the forex market, connecting traders to major liquidity providers like banks and other financial institutions. This setup allows for tighter spreads and more competitive pricing, as traders can execute against the real-time bids and offers from these providers. ECN brokers stand out for their transparency, as they provide visibility into the market depth and the actual prices available in the market, which can be particularly advantageous for strategies that require precise execution.

The commission-based model of ECN brokers, while offering the benefit of lower spreads during periods of high liquidity, means traders need to account for these costs when planning their trades. This makes ECN brokers a preferred choice for experienced traders who value quick execution and access to substantial liquidity. Unfortunately, this option may be less beginner-friendly as it requires a substantial initial deposit.

STP/NDD Broker

STP (Straight Through Processing) and NDD (No Dealing Desk) brokers streamline the forex trading process by directly passing client orders to liquidity providers, which can include banks, other brokers, or financial institutions.

This model ensures that trades are executed without the intervention of a dealing desk, providing traders with faster execution speeds and often more competitive spreads. Since these brokers profit from either small commissions or through mark-ups on the spread, they align their interests with those of their clients, aiming to secure the best possible trading conditions.

Although STP/NDD brokers offer several benefits, including improved execution and access to deep liquidity pools, they may also require higher minimum deposits compared to market makers. Additionally, the variable spreads offered can widen significantly during high volatility or low liquidity conditions, potentially increasing trading costs unexpectedly. Despite these considerations, STP/NDD brokers are a solid choice for traders looking for direct market access with minimal intervention and more predictable execution.

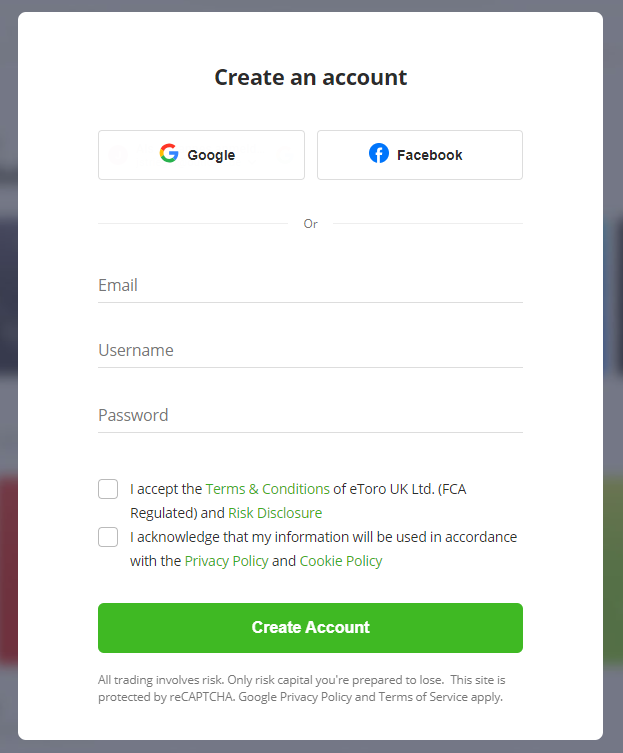

Opening an Account With a Broker: eToro

When opening an account with eToro, the process is streamlined and user-friendly, designed to welcome traders of all levels. This section will guide you through the key steps: registering with eToro, verifying your account, depositing funds, and initiating your first trade.

Registering with eToro

To register with eToro, follow these steps, keeping in mind the platform’s aim for a user-friendly and secure start:

- Navigate to eToro’s Website: Access eToro’s homepage and locate the “Join eToro” button. Click this button to begin the registration process.

- Provide Basic Information: Enter essential details such as your email address, username, and choose a secure password. Alternatively, opt for quick registration via Google or Facebook to save time.

- Agree to Terms and Conditions: Read and accept eToro’s terms, privacy policy, and cookies policy to proceed. It’s crucial to understand the platform’s rules and your rights as a user before trading.

- Activate Your Account: Check your email for an activation link from eToro and click on it to confirm your account setup. This step is vital for verifying your email address and securing your account.

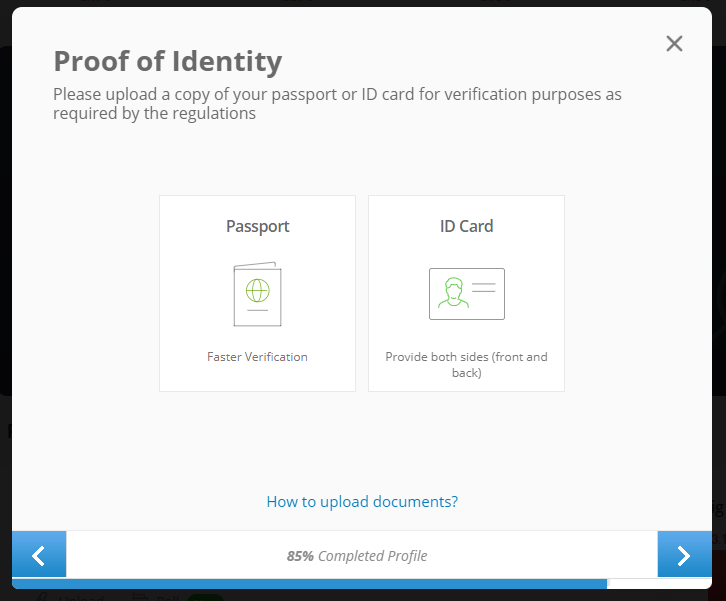

Verify the Account

After registering with eToro, the next step is to verify your account, a standard requirement to ensure compliance with financial regulations and enhance the security of your trading experience. This process involves submitting proof of identity and proof of address documents.

- Proof of Identity: You can use a government-issued ID, such as a passport or driver’s license. The document must be valid and clearly show your full name, date of birth, and photo.

- Proof of Address: This can be a utility bill, bank statement, or any official document dated within the last six months that has your name and current address on it.

Deposit Funds

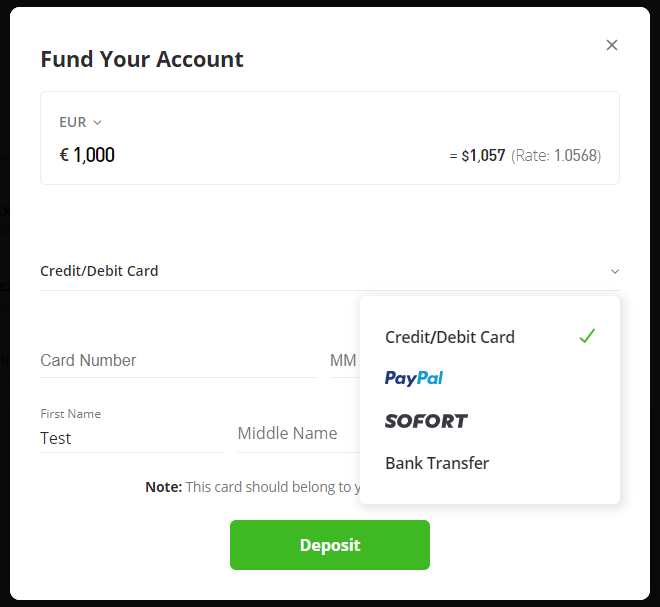

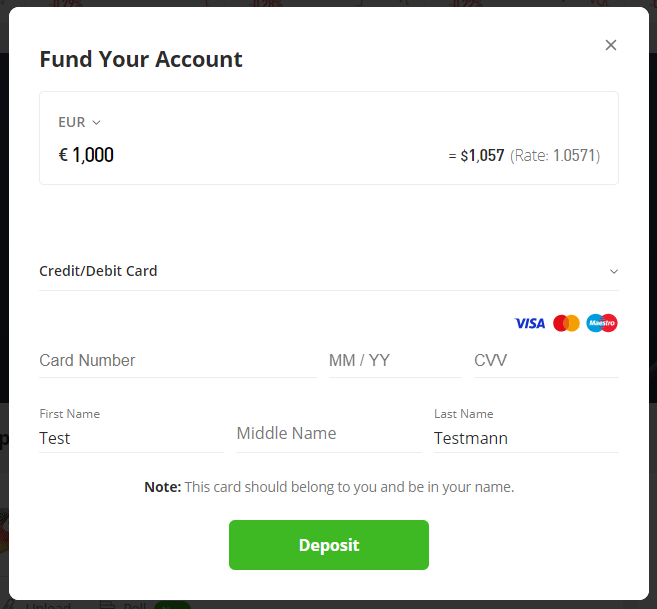

Once your eToro account is verified, you’re set to deposit funds and start trading. eToro simplifies this process with several payment methods to accommodate users worldwide:

- Choose Your Payment Method: eToro supports a variety of options, including credit/debit cards, bank transfers, and e-wallets like PayPal, Skrill, and Neteller, among others. Select the one that is most convenient for you to use.

- Enter Deposit Amount: There’s a minimum deposit amount, which varies by country. Ensure you’re aware of this threshold and enter the amount you wish to start with.

- Complete the Transaction: Follow the prompts to finalize your deposit. For most methods, the funds will appear in your eToro account almost instantly, allowing you to begin trading without significant delays.

How to Trade With eToro

Finally, you can begin trading after setting up your account and funding it. Here’s a step-by-step guide on how to trade.

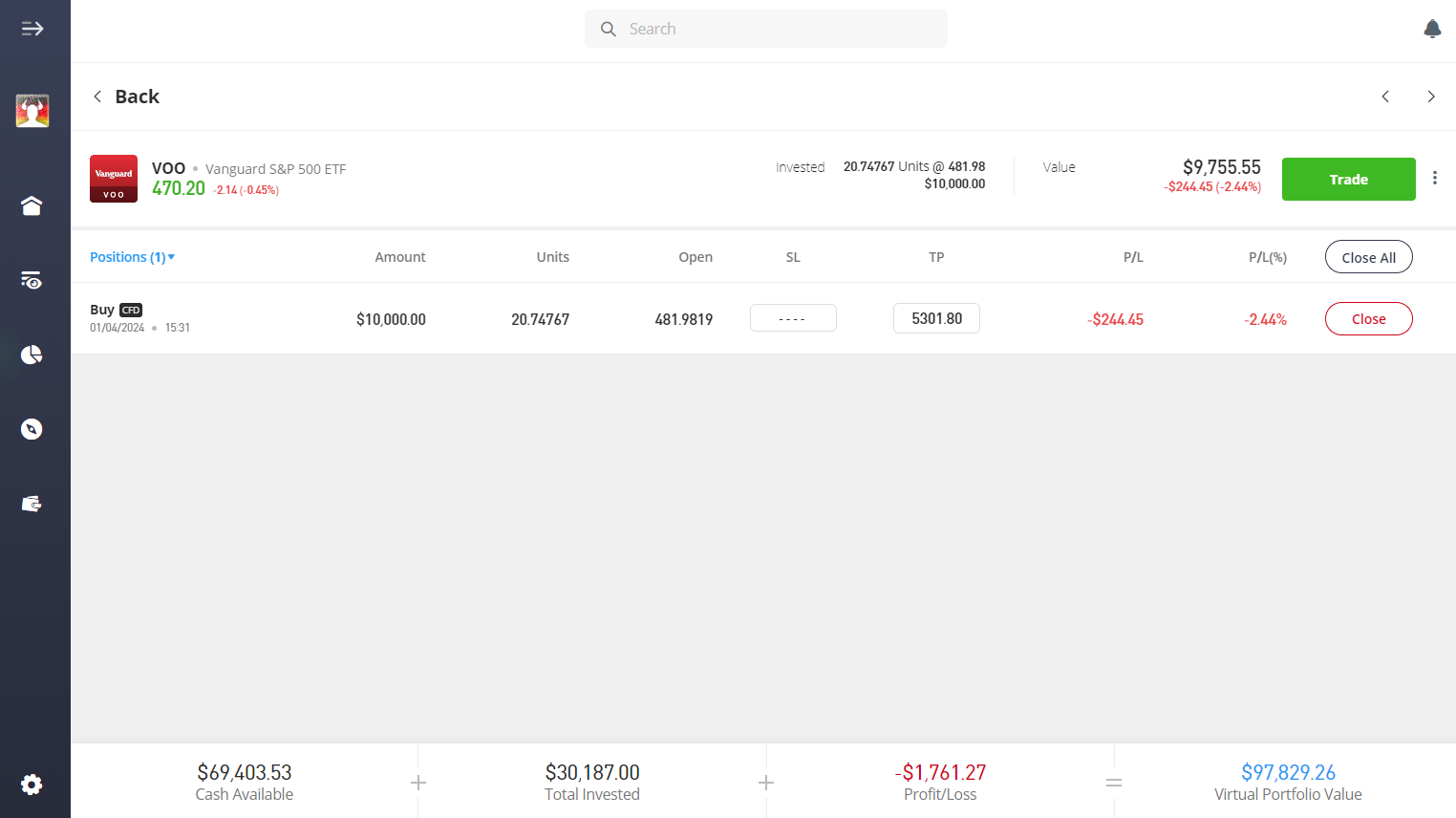

- Navigate the Platform: Log in to your eToro account and use the search bar at the top to find the specific market or asset you’re interested in trading. eToro offers many assets, including stocks, cryptocurrencies, ETFs, and more.

- Analyze: Utilize eToro’s comprehensive tools to analyze the asset. This includes historical price data, market sentiment, and expert analyses available on the platform.

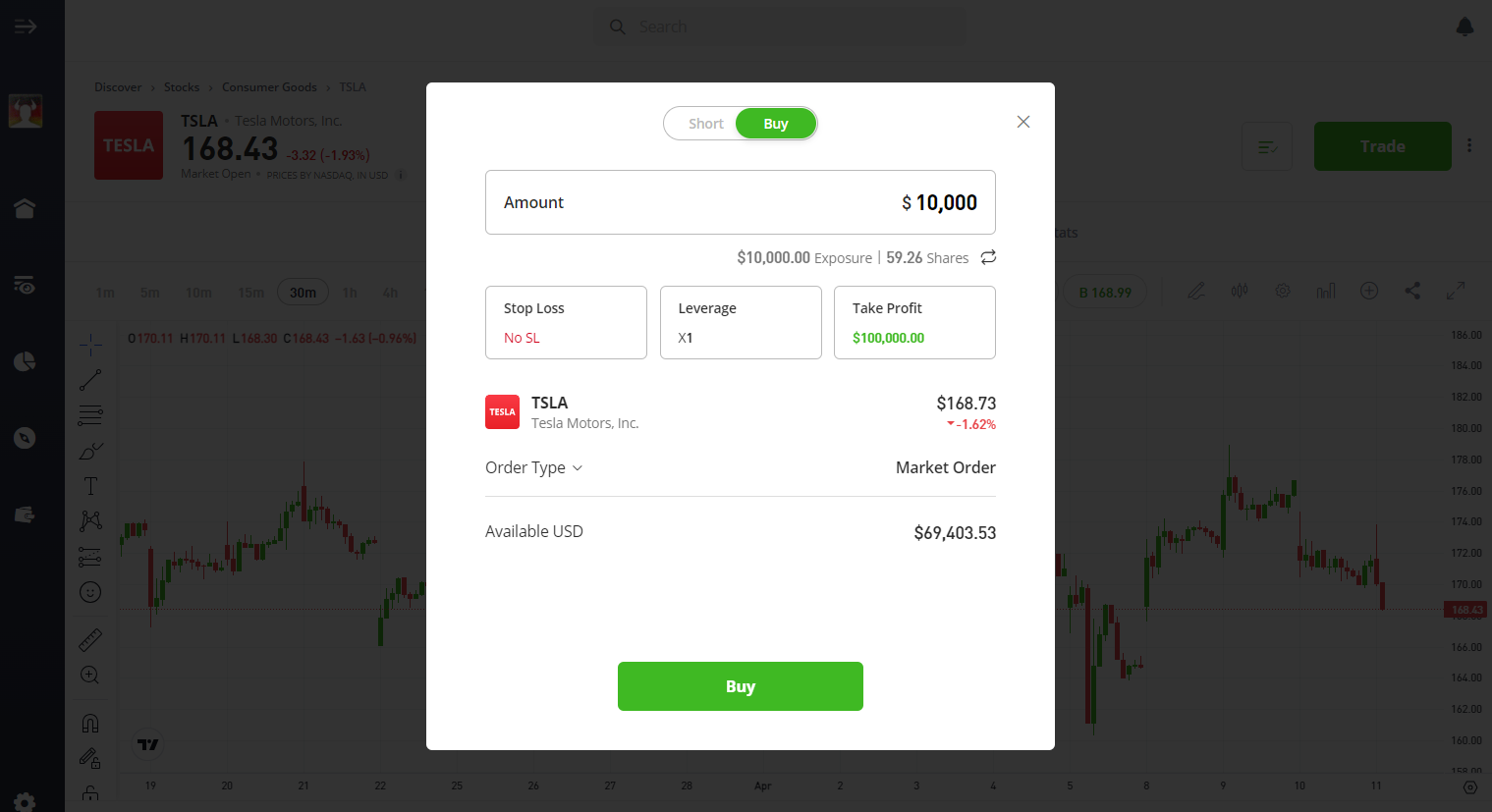

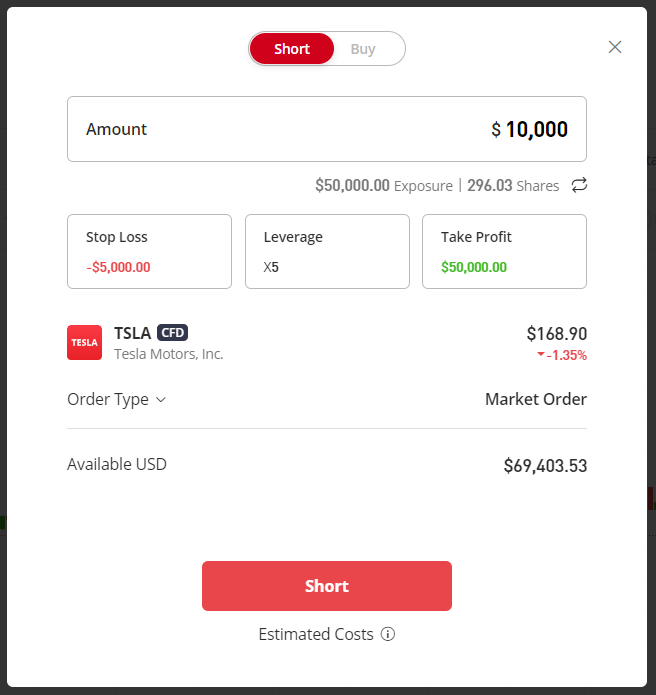

- Open a Trade: Once you’ve selected an asset, click on it to open a new trade window. Here, you can set the amount you wish to invest, leverage (if applicable), stop loss, and take profit levels. For beginners, starting with smaller investments and using the stop-loss feature to manage risk is advisable.

- Monitor Your Portfolio: After executing your trade, you can monitor its performance through your portfolio page. eToro also offers social trading features, allowing you to follow and copy the trades of successful investors as part of your strategy.

Improve Your Trading With a Trading Mentorship Program

Participating in a trading mentorship program can be a game-changer for new and experienced traders. A well-structured program provides personalized guidance, tailored strategies, and direct feedback, helpful for navigating the complexities of the financial markets. For beginners, the value of one-on-one coaching cannot be overstated; it accelerates the learning process, helps avoid common pitfalls, and builds confidence in trade execution.

Witzel Trading stands out as an exemplary mentorship program, especially suited for newcomers eager to become successful traders. It offers comprehensive support through one-on-one help, detailed guides, and access to multiple webinars each month. This ensures continuous learning and adaptation to the ever-changing markets.

Additionally, Witzel Trading provides personal support and trade analysis, enabling traders to understand their decision-making process and improve their strategy over time. For anyone looking to fast-track their trading proficiency with focused, expert guidance, Witzel Trading’s mentorship program is an excellent starting point.

Online Brokers vs. Banks

Online brokers stand out for their low costs, broad market access, and advanced tools. They cater specifically to traders looking for efficiency and flexibility. With lower overheads than traditional banks, online brokers can offer competitive pricing on trades and no account minimums, making them a cost-effective choice. Their platforms are designed with the trader in mind, featuring real-time data, analytical tools, and mobile trading capabilities that appeal to both beginners and experienced traders.

In contrast, banks often have higher fees for trading services and may lack the specialized tools and platforms that online brokers provide. While banks offer the convenience of integrating trading with other financial services, they typically can’t match the range of assets, market access, and trading technology available through online brokers. For those focused on active trading and seeking to maximize their investment opportunities, online brokers present a clear advantage.

Conclusion: eToro Wins This Broker Test and There Are 9 Other Top Alternatives

eToro leads our comparison with its user-friendly interface, diverse trading options, and unique social trading feature, appealing to both beginners and those keen on leveraging community insights. Its transparent approach to fees, rigorous security measures, and reliable customer support solidify its top position.

However, among the top contenders, brokers like Freedom24, XTB, and Admiral Markets offer distinct advantages, catering to various trading preferences and needs. Freedom24 is noteworthy for its direct access to IPOs, XTB stands out for its comprehensive educational resources, and Admiral Markets excels in offering a wide range of instruments and competitive spreads.

Each broker in the top 10 list brings something valuable to the table, whether it’s specialized platforms, trading conditions, or support services, emphasizing the importance of matching your choice with your trading strategy and priorities. Thorough research and testing through demo accounts are advisable to find the broker that aligns with your trading goals.

Frequently asked questions on Online Brokers:

What Do Online Brokers Do?

Online brokers provide platforms where individuals can buy and sell financial instruments like stocks, bonds, and forex. They act as intermediaries between the market and traders, offering tools for trading, research, and analysis. Brokers enable access to global markets, catering to investors of all levels.

Which Online Stock Broker Is Best?

The best online stock broker depends on the trader’s needs, trading style, and the features they value most, such as low fees, extensive research tools, or a wide range of available investments. eToro, for its broad appeal and innovative features, often ranks highly among diverse trader demographics.

Which Broker Is Best for Beginners?

eToro is considered one of the best brokers for beginners due to its intuitive platform, educational resources, and the unique opportunity to learn from and copy the trades of experienced investors. Its supportive community and straightforward pricing also make it a welcoming platform for newcomers.

Is It Worth Using a Broker?

Yes, using a broker is worth it for most investors, as brokers provide valuable services like access to financial markets, trading platforms, and support resources that would be difficult to obtain otherwise. They also offer security for transactions and can help navigate the complexities of investing.

Do Online Brokers Charge Fees?Do Online Brokers Charge Fees?

Yes, online brokers charge fees, which can include commissions on trades, spreads, account maintenance fees, and inactivity fees. However, fee structures vary widely among brokers, with some offering commission-free trades or low-cost services to remain competitive.

How Can I Buy Stocks Online Without a Broker?

Buying stocks online without a broker is possible through Direct Stock Purchase Plans (DSPPs) offered by some companies. These plans allow investors to buy shares directly from the company without going through a broker, often with lower fees and the option for automatic reinvestment of dividends.