Forex trading is a global marketplace where currencies are bought and sold. It’s the world’s largest and most liquid financial market, offering immense opportunities for those willing to learn and participate. In this comprehensive tutorial designed for beginners, we’ll explore every aspect of Forex trading, from its basic definition to popular strategies.

Whether you’re new to trading or looking to expand your knowledge, this guide will provide you with information and resources needed for Forex trading.

Key Facts Forex Trading

- Forex is a global marketplace for exchanging currencies, offering significant opportunities for profit with the right strategies and knowledge.

- The Forex market operates continuously, facilitated by major financial centers worldwide.

- Traders can profit from both upward and downward movements in currency prices by buying (going long) or selling (going short) currency pairs.

- Forex trading carries inherent risks, including market volatility, leverage-induced losses, and geopolitical events affecting market prices.

- Traders employ a combination of technical analysis, fundamental analysis, and market sentiment to make informed decisions, alongside risk management techniques to protect their capital.

What Does Forex Mean?

Forex, short for foreign exchange, is the global marketplace where currencies are traded. It’s the basis of international trade and investment, facilitating transactions between countries and businesses. Every time you travel abroad, make an online purchase from an overseas retailer, or invest in foreign stocks, you are indirectly participating in the Forex market.

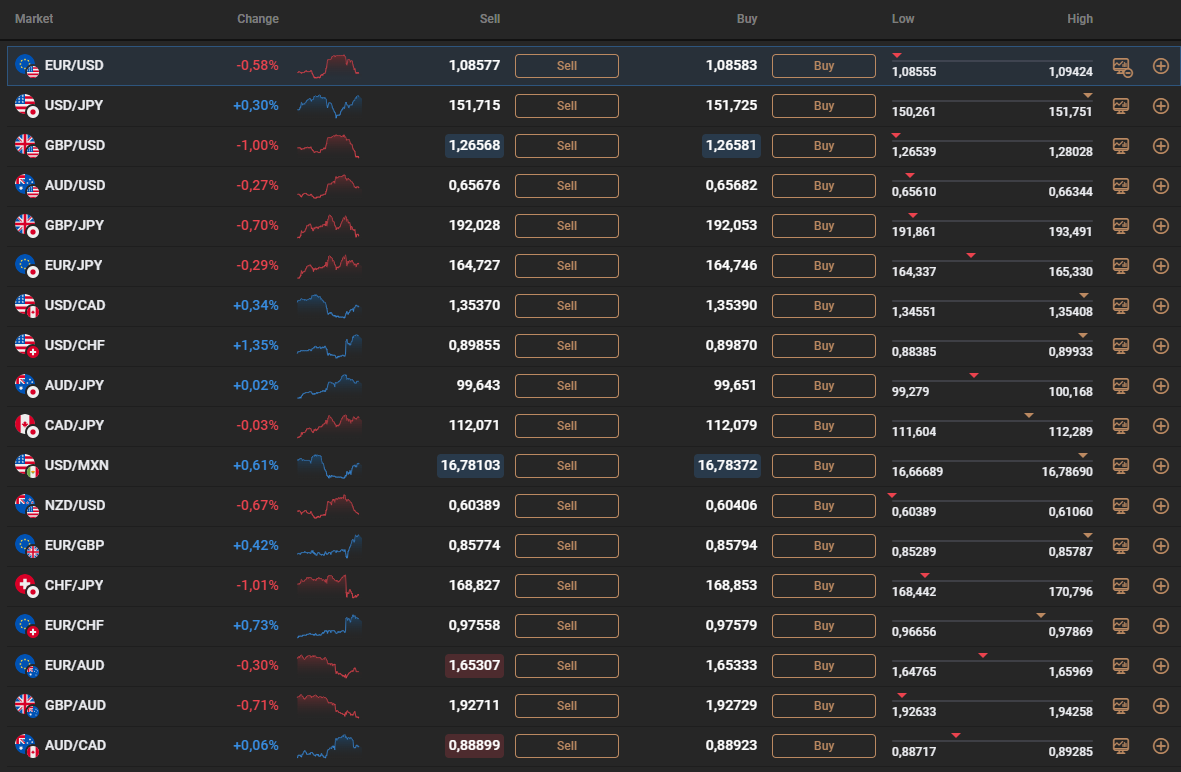

How Does Forex Trading Work? – Understanding Opportunities and Risks

Forex trading involves buying one currency while simultaneously selling another currency. This transaction is executed in currency pairs, where one currency is the base currency, and the other is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency. For example, in the EUR/USD pair, if the exchange rate is 1.10, it means that 1 Euro can be exchanged for 1.10 US Dollars.

The forex market operates in sessions, with each major financial center around the world, such as London, New York, Tokyo, and Sydney, contributing to trading volume during its respective session. This continuous trading activity ensures liquidity, meaning buyers and sellers are always available for any given currency pair. Also, technological advancements have led to the rise of electronic trading platforms, enabling traders to execute trades fast and efficiently from anywhere with an internet connection.

Traders speculate on the future movement of currency pairs, aiming to profit from fluctuations in exchange rates. They can take two primary approaches: buying (going long) or selling (going short) a currency pair. If a trader believes that the value of the base currency will increase relative to the quote currency, they would buy the currency pair. Conversely, if they anticipate a decline in value, they would sell the currency pair.

Forex Trading Opportunities

Forex trading offers multiple opportunities for individuals to capitalize on market movements and generate profits. Traders can benefit from both upward and downward currency movement, allowing them to profit regardless of market direction.

Additionally, the forex market operates 24/5, giving ample opportunities to trade during the week. Moreover, financial events usually increase market volatility, allowing traders to capitalize on price fluctuations.

Risks of Forex Trading

While forex trading can be lucrative, it also has inherent risks traders must be aware of. These are the top 5 risks when trading forex:

- Volatility: One of the primary risks is market volatility, which can lead to rapid and unpredictable price movements. If traders are not prepared for increased volatility, it can lead to them losing substantial amounts of money.

- Leverage: Forex trading often involves using leverage, which can amplify profits. However, it also magnifies losses, increasing the risk factor for traders.

- Counterparty Risks: Trading in the forex market requires transacting with counterparties, such as brokers and financial institutions. There is a risk of counterparty default, particularly when dealing with unregulated brokers or trading in over-the-counter markets. Traders should choose reputable platforms with proper regulation to mitigate risks.

- Psychological Factors: Emotional trading, driven by fear, greed, or impulsivity, can impair judgment and lead to poor decision-making. Traders failing to stick to their trading plan increases the likelihood of losses. Traders must maintain discipline and emotional control to mitigate this risk.

- Geopolitical Risk: Geopolitical events, such as wars, conflicts, or diplomatic tensions, can profoundly affect currency markets. Uncertainty surrounding geopolitical developments can lead to rapid price movements, affecting trade positions that have already been made. This could either lead to huge losses or winning trades.

How Do Forex Investors Trade?

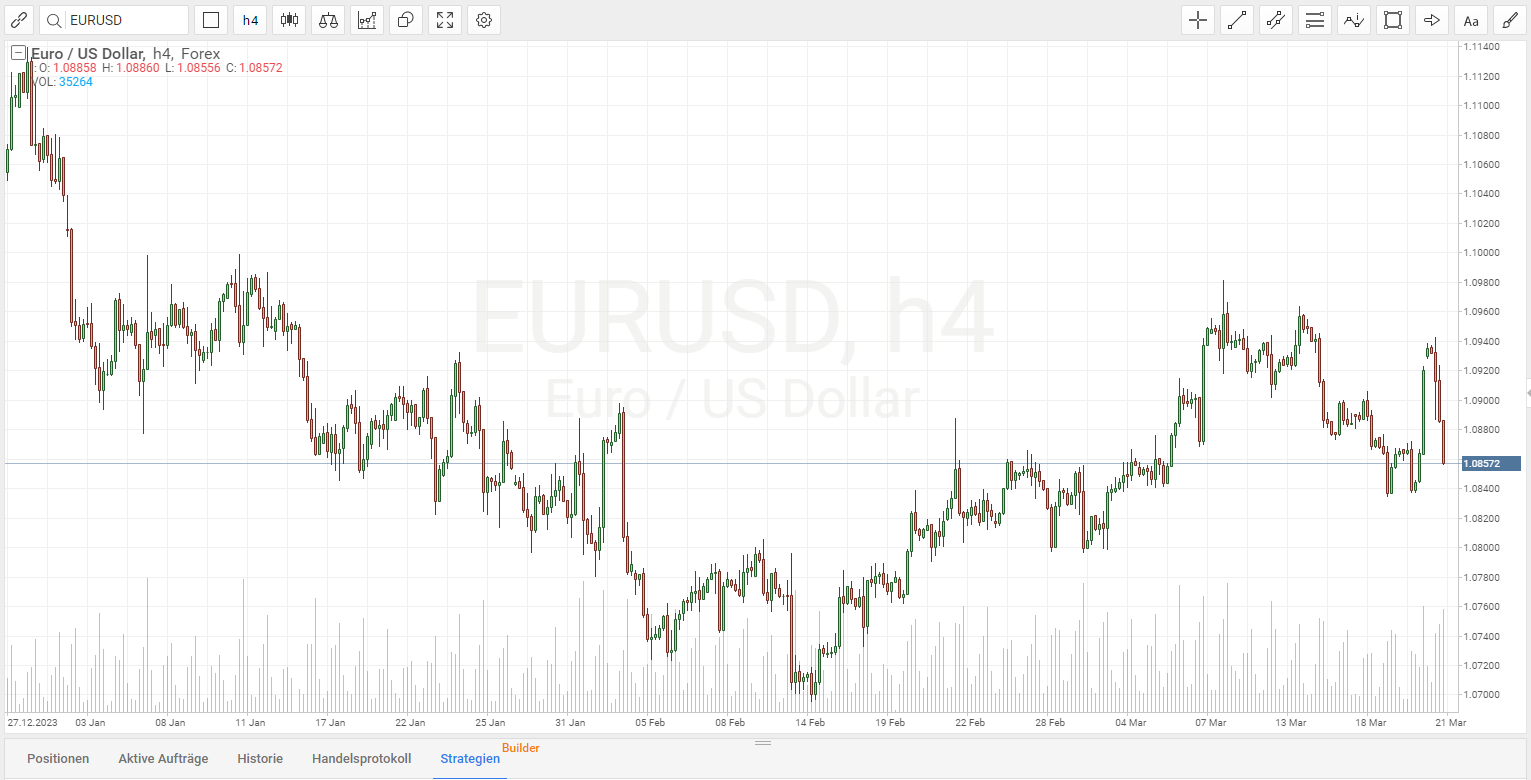

Forex traders use a combination of technical analysis, fundamental analysis, and market sentiment to make informed trading decisions. Technical analysis studies historical price data and chart patterns to identify trends and entry points. Trades use a variety of technical indicators for this, such as moving averages, Relative Strength Index, and Bolling Bands, to analyze movements and gauge the market. Depending on the strategy, various tools are available for technical analysis.

Fundamental analysis, on the other hand, focuses on economic indicators, geopolitical events, and central bank policies to assess the underlying strength of a currency. Traders monitor economic releases such as GDP growth, inflation rates, and employment reports to anticipate how these factors may influence currency prices. Additionally, geopolitical events like elections, trade agreements, and tensions can impact currency value.

Furthermore, market sentiment plays an important role in forex trading, as it reflects the collective psychology of market participants. Traders often use sentiment indicators, such as the Commitment of Traders (COT) report and the Fear and Greed Index, to gauge the prevailing mood in the market. By understanding whether sentiment is bullish or bearish, traders can adjust their trading strategies accordingly.

In addition to technical analysis, fundamental analysis, and market sentiment, successful forex traders also employ risk management techniques to protect their capital. This may include setting stop-loss orders, diversifying their portfolio, and having strict risk-reward ratios for each trade.

Types of Foreign Exchange Markets – Explaining the Forex Market

In forex trading, different market types serve specific purposes in facilitating currency exchange. Understanding these market variations is essential for beginners as you’ll have to decide which market type you’ll want to trade in. This section explores the primary types of foreign exchange markets: spot and future.

Spot Market

The spot market is the primary avenue for currency trading. Unlike other financial markets where transactions may be agreed upon for future settlement, spot market transactions are settled on the spot or within a short period, typically 2 business days. This immediacy is essential for traders looking to execute currency trades quickly, whether for speculative purposes or for fulfilling immediate business needs.

The spot market operates on the principle of supply and demand, with prices determined by current market conditions at the time of the trade. This real-time pricing mechanism ensures traders have access to up-to-date market information, allowing them to make informed trading decisions.

Moreover, the spot market has high liquidity, meaning there is a huge pool of buyers and sellers actively participating in currency trading. This liquidity ensures traders can enter and exit positions with ease without significantly impacting market prices.

Market participants in the spot market include banks, financial institutions, corporations, governments, and individual traders, each with their own objectives and motivations for currency trading.

Futures Market

In forex trading, the futures market is a specialized segment where traders enter into contracts to buy or sell currencies at a predetermined price and date in the future. Unlike the spot market, where transactions are settled immediately, futures contracts have specified expiration dates, typically months into the futures. Futures contracts can also have long and short positions to take advantage of rising or falling prices.

These contracts are standardized and traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE). These institutions provide transparency and liquidity for market participants.

Futures contracts also allow traders to leverage their positions, enabling them to control much larger positions. This can amplify profits but is more risky as predicting prices days or months in advance is tricky. Also, futures contracts are commonly used for hedging purposes, allowing market participants to manage currency risk associated with international trade and investment.

Pros and Cons of Forex Trading

| Pros | Cons |

|---|---|

| ✅ High liquidity for trading | ❌ Forex has fees for trading |

| ✅ Lucrative trading opportunities | ❌ Leveraging can lead to huge losses |

| ✅ Many brokers offer educational content for beginners | ❌ Unexpected events can lead to volatility, leading to trade losses. |

| ✅ Hedging opportunities | ❌ Big learning curve to become a successful trader |

| ✅ Ability to profit from falling and rising prices | ❌ Difficult to predict the future with futures contracts |

| ✅ Diverse trading opportunities | ❌ Psychological pressure can lead to impulsive trading decisions |

| ✅ Wide range of currencies available to trade | ❌ Returns are not guaranteed |

| ✅ Tax advantages in some jurisdictions | ❌ Some platforms are not regulated |

| ✅ Flexibility in trading hours | ❌ Data and analysis tools can cost money |

| ✅ Demo accounts available for practicing | ❌ Must commit a lot of time to learn how to become a proper forex trader |

Is Forex Trading Reliable?

Yes, forex trading can be reliable for traders who approach it with the right strategies and mindset. Many traders have found success in the forex market by applying sound trading principles, managing risk effectively, and continuously learning while adapting to market conditions.

Moreover, forex trading is considered a reliable trading instrument as the market is well developed. Its high liquidity and accessibility make it an attractive option for traders worldwide. However, while some traders may find consistent success, others may encounter challenges and setbacks. Market volatility, geopolitical events, and economic data releases can impact how well a trader may succeed.

By staying informed about market trends, employing effective risk management techniques, and using up-to-date strategies, traders can find forex to be a reliable income generator.

Explaining the Basics of Forex Trading

Understanding the basics of forex trading is essential for beginners because it lays the foundation for navigating the complexities of this market. By learning fundamental concepts and terminology, novice traders will better understand how forex trading works and make informed decisions when entering the market. Let’s explore the main aspects of forex trading.

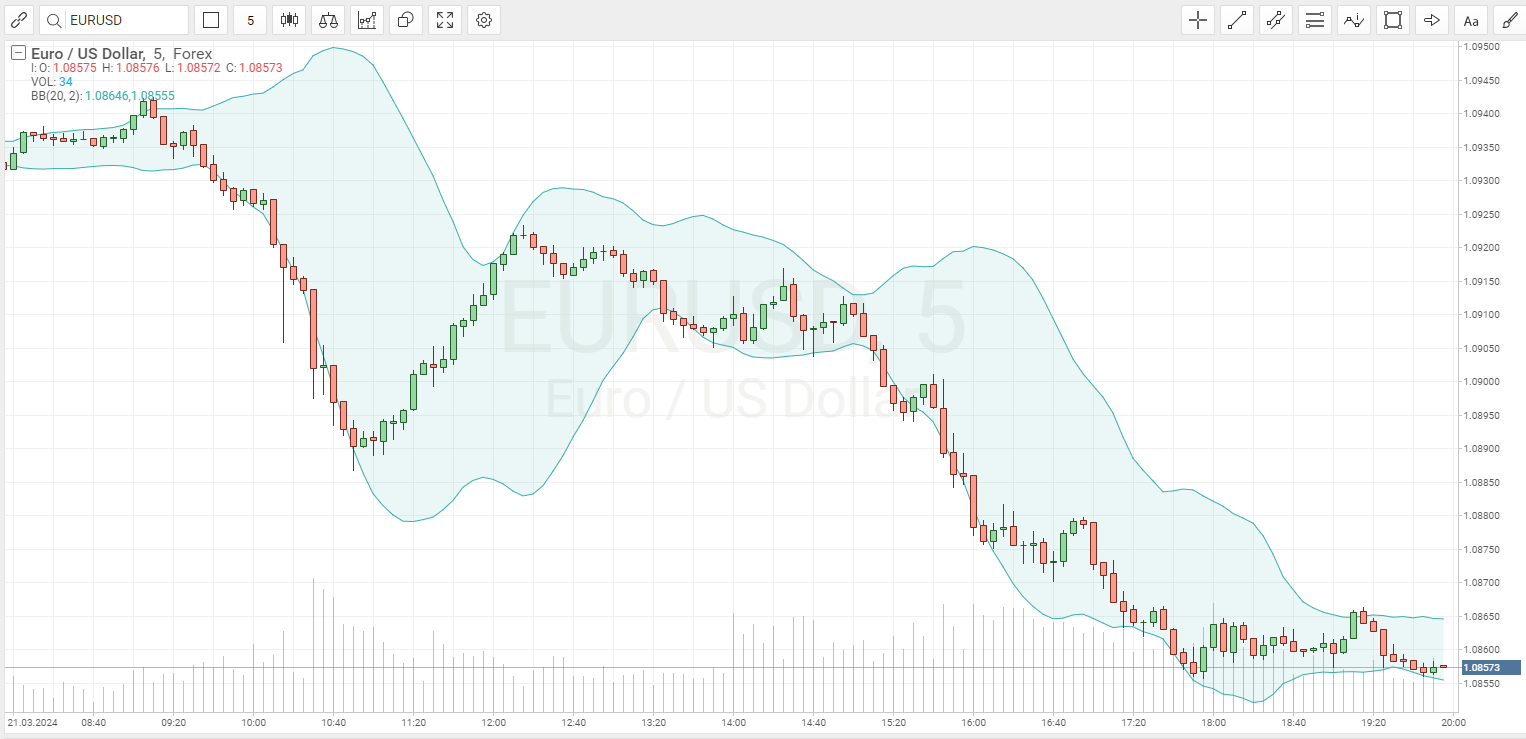

Volatility

Volatility indicates the degree of price fluctuation experienced by currency pairs over a specific timeframe. It’s a critical concept for traders to grasp as it directly influences the potential risks and rewards associated with trading currencies. When volatility is high, currency prices can experience significant swings, offering traders opportunities to profit but carrying more risk. Conversely, low volatility implies more stable price movements and predictability.

Traders use volatility to measure market uncertainty and adjust their strategies accordingly. To navigate volatility effectively, traders must use various techniques, such as adjusting position sizes, setting stop-loss, and take-profit.

Beginners should also use technical indicators to determine how volatile a currency pair is and base their trades on this information. These indicators offer reliable information that can help with entry and exit points as well as predict future price movements.

Pip

In forex trading, a pip represents the smallest unit of price movement in currency pairs. It stands for percentage in point or price interest point. Essentially, a pip indicates the incremental change in the exchange rate of a currency pair, denoted by the last decimal place in the price quote. For example, if the EUR/USD currency pair moves from 1.0900 to 1.0901, it has moved by 1 pip.

Learning pips are important for beginners as they are the basis for measuring price changes and calculating profits or losses. In most currency pairs, a pip equals 0.0001, while in others, it may represent 0.00001.

Moreover, pips play a vital role in determining the spread, which is the difference between a currency pair’s bid and ask prices. Usually, platforms disclose the spreads in pips, making them easier for traders to understand.

Spread

The spread is the difference between a currency pair’s bid price (the price at which buyers are willing to buy) and the ask price (the price at which sellers are willing to sell). It’s the cost of executing a trade and is measured in pips. Spreads are basically fees that are built into the pricing of an exchange. Most brokers will not charge a commission but instead apply a spread to generate profit.

Understanding spreads is essential because it impacts profitability. For example, if the EUR/USD currency pair has a bid price of 1.2000 and an ask price of 1.2002, the spread would be 2 pips. The tighter the spread, the lower the cost of trading, making it more favorable for traders. Wider spreads increase the cost of trading and will reduce overall profitability.

Brokers may offer fixed or variable spreads, with variable spreads fluctuating depending on market conditions. In comparison, fixed spreads remain constant regardless of how the market performs.

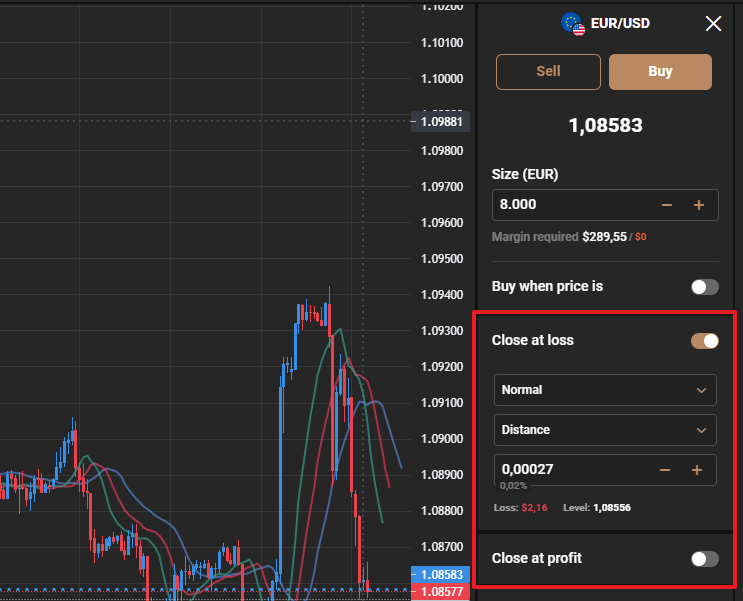

Stop-Loss / Take-Profit

Stop-loss and take-profit are risk management tools traders use to control their positions and protect their capital. A stop-loss order is a predetermined price level a trader sets to limit potential losses on a trade. When the currency pair reaches the stop-loss level, the trade is automatically closed, preventing further losses beyond the predetermined threshold.

Let’s say you buy a currency pair at 1.2000, expecting it to rise, you may want to set a stop loss at 1.980 to limit losses if the market swings downward. Stop-loss ensures you can exit the trade before the losses become too large, helping preserve your trading capital.

On the other hand, take-profit is a tool traders use to secure their profits on a trade. Similar to stop-loss, take-profit is also set at predetermined price levels. Once the market reaches this level, trades are automatically closed, locking in profits.

For example, if you buy a currency pair at 1.2000, you might set a take profit at 1.2050. If the price reaches 1.2050, your trade will be closed, and profits will enter your trading balance. Take-profit ensures traders don’t miss out on potential gains by staying in a trade for too long.

Margin / Margin Call

Leverage is a common tool in forex trading because it can dramatically increase profits. However, it comes with much more risk, so beginners may want to avoid using it until they gain enough experience. Leverage and margin are closely tied together, and knowing how they work is important for beginners. Let’s take a closer look at what margin is.

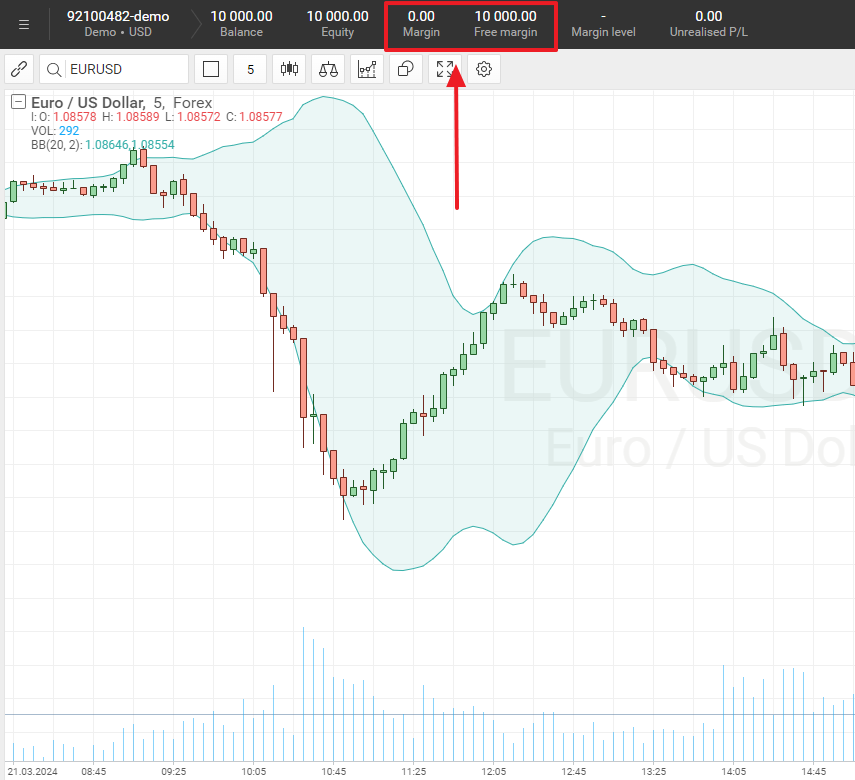

Margin

Margin is the amount of money traders must deposit with their broker to open and maintain a trading position. It allows traders to control larger positions with a smaller amount of capital, thus amplifying potential profits and losses. For example, if your broker offers leverage of 1:50, you can control a position worth $50,000 with a margin of $1,000.

Margin Call

A margin call is a notification from your broker indicating that your account’s margin level has fallen below the required minimum level. This occurs when your losses on open positions exceed the margin in your account. When you receive a margin call, it’s a warning sign that your account is at risk of being liquidated if you don’t take action.

To address a margin call, traders can either deposit additional funds into their account to meet the margin requirements or close losing positions to reduce their exposure. However, if traders do nothing and the currency pair reaches the liquidation value, the broker will automatically close the position to cover losses.

Can You Learn Forex Trading?

Yes, forex trading is a skill that can be learned by anyone with the dedication and willingness to put in the time. While it may seem daunting initially, especially for beginners, anyone can become proficient in forex trading with the right approach and resources.

Learning forex trading involves understanding fundamental concepts, such as currency pairs, price movements, technical analysis, and risk management. Fortunately, numerous resources are available to help beginners learn the ins and outs of forex trading. These include online courses, educational articles, videos, and trading forums.

One of the best ways to learn forex trading is through hands-on experience. Demo trading accounts allow beginners to practice in a simulated environment with virtual funds, enabling them to gain practical experience without risking money. This lets beginners make mistakes without consequences and learn from the errors.

How to Learn Forex Trading – Step-By-Step Tutorial

Learning to trade forex can be exciting yet challenging, especially if you’re just starting. In this section, we’ll provide a straightforward step-by-step tutorial on how to learn forex trading effectively. From selecting the right broker to finding trade entry points, we’ll guide you on the right path.

Step 1 – Choosing the Right Forex Broker (FP Markets / Vantage Markets / RoboForex)

The first step is to select the right forex broker. A reliable broker provides all the essential services a trader would need. Here are some aspects to consider when looking at a broker:

- Regulation: Ensure the broker is regulated by a reputable financial authority, as this provides trustworthiness and a layer of security for your funds. It also ensures fair trading practices as the broker’s operations are closely looked at.

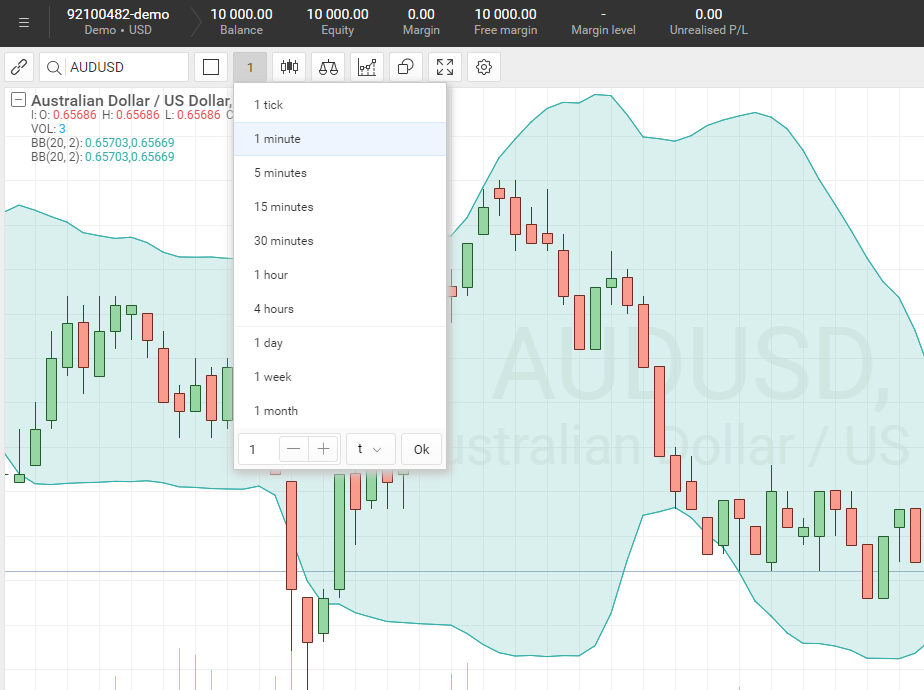

- Trading Platform: Evaluate the trading platforms offered by the broker to ensure they meet your needs and standards. They should contain tools for analysis and trade execution. Use a demo account to access the platform for free and test the service to see if it matches your requirements.

- Spreads and Fees: Compare the spreads and fees of different brokers to find competitive pricing that suits your trading style and budget.

- Customer Support: Look at the quality of customer support, like responsiveness, availability, and professionalism. Ideally, the broker should provide email, live chat, and phone support.

- Educational Resources: The educational material should be in-depth and understandable for beginners. The platform must provide tutorials, webinars, market analysis, and courses.

- Assets Available: Consider what forex pairs are offered and if they provide the currencies you intend to trade.

After considering and applying these criteria to brokers, choose one that best suits your needs. To save you time researching, here are three great forex brokers that offer great tools for traders.

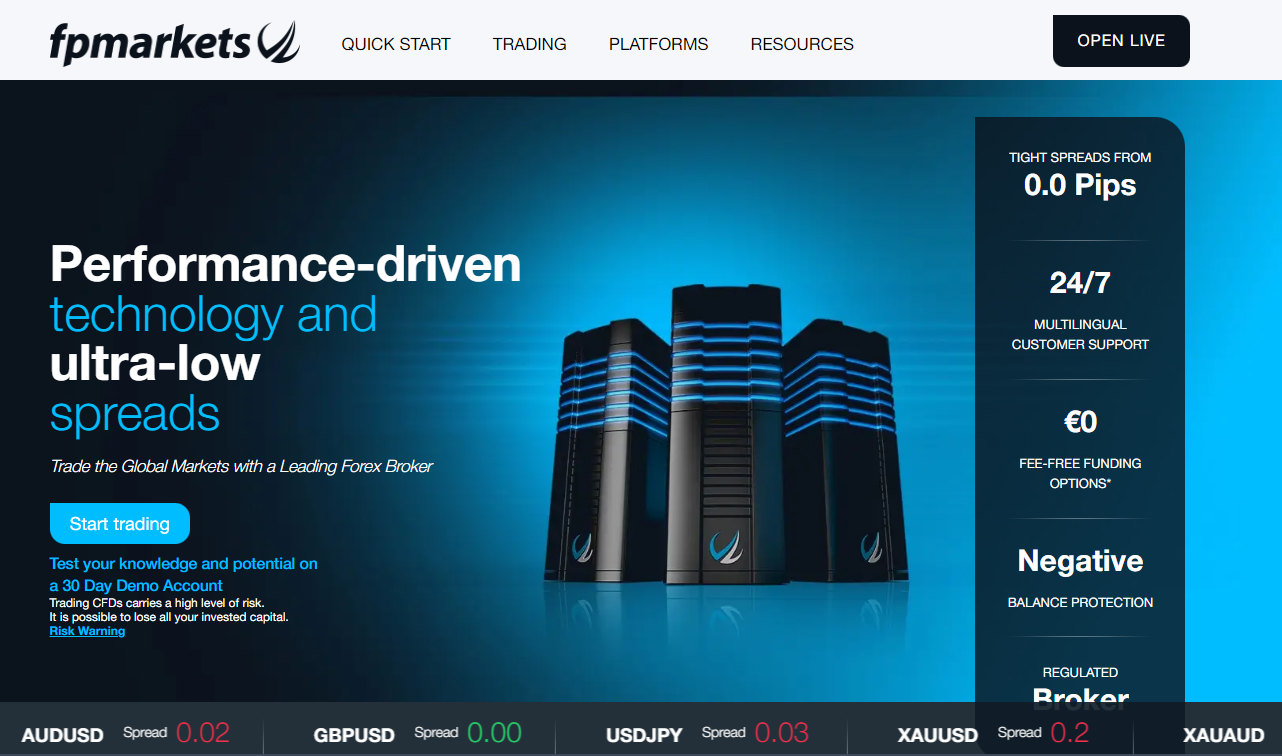

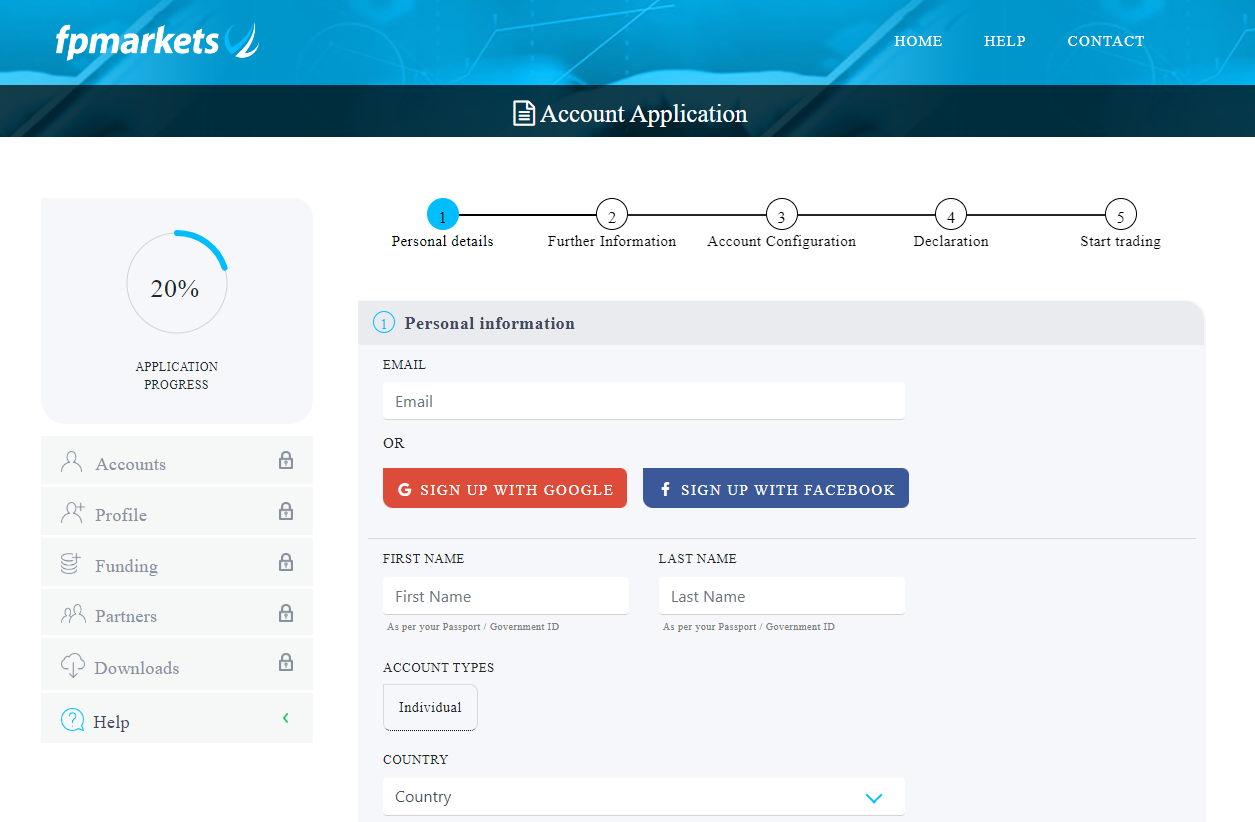

FP Markets

FP Markets is a globally recognized forex and CFD broker known for its extensive range of trading instruments and competitive trading conditions. With over 15 years of experience in the financial markets, FP Markets offers traders access to a wide range of asset classes, including forex. The broker provides traders access to multiple trading platforms like MetaTrader 4 and MetaTrader 5.

Furthermore, FP Markets offers competitive pricing with low commissions, making it great for forex trading. As stated on their website they have tight spreads from 0.0 pips. The broker also provides educational resources such as video tutorials and a glossary for trading. Also, newcomers can open a forex trading account that comes with multiple benefits. Users can decide what trading platform to use, and the minimum amount to get started is $50. Overall, we believe FP Markets is one of the best options for beginners.

Vantage Markets

Vantage Markets is one of our top choices. It’s a professional forex broker offering traders a comprehensive range of forex trading services. The broker provides access to many currency pairs, including major, minor, and exotic, allowing traders to take advantage of multiple global forex opportunities. Vantage Markets is committed to providing a great experience for the user, as a result, currency pairs have tight spreads, ensuring cost-effective trades.

Traders can utilize the MetaTrader 4 trading platform, known for its user-friendly interface, advanced charting tools, and technical analysis capabilities. The broker also contains educational material under the “Learn” section. Here, you can find ebooks, webinars, courses, and articles about forex trading. Also, it contains a dedicated section for analysis that provides insights into the market.

Demo accounts are available for learning with virtual credit. It provides access to the same asset classes and products as a live account, letting traders try out the platform before using real money. If you require more information about the platform, their dedicated support team is available 24/7 to answer any questions.

RoboForex

RoboForex is another reputable forex broker offering traders a great selection of currency pairs. The broker provides MetaTrader 4, MetaTrader 5, and cTrader, giving traders a choice of platforms to suit their trading preferences. Also, the fee structure is competitive and can start from 0 pips.

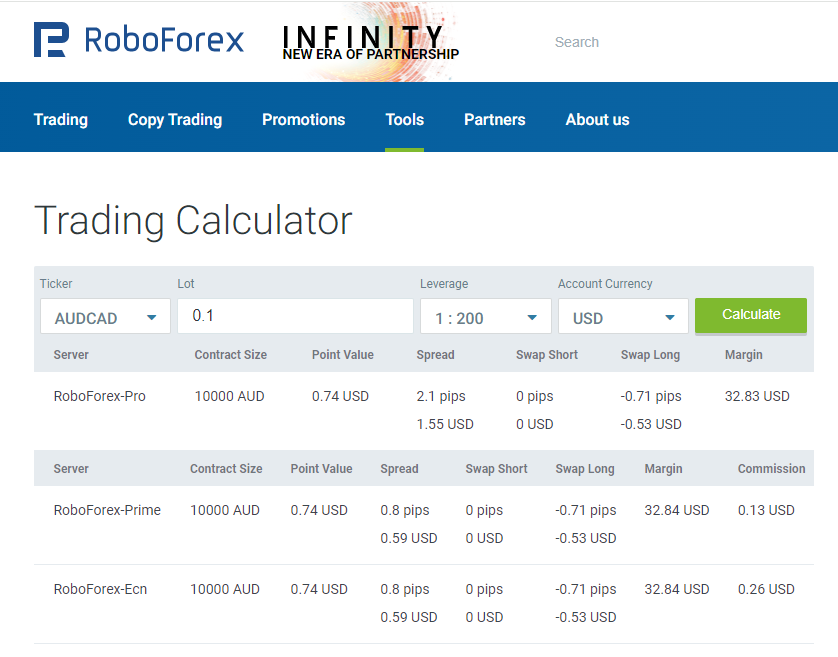

The tools section is comprehensive and provides market analysis with an economic calendar. It also has a calculator so beginners can input a trade they are interested in making and visually see the spreads, margins, and other important information.

Furthermore, RoboForex has a great range of promotions for its users. New users will receive a welcome bonus of $30 that can be applied to trading and can enroll in the cashback program. However, if you’re an experienced trader or plan to use leverage in the future, RoboForex offers up to 1:2000 leverage.

Step 2 – Registering With a Forex Broker

Registering with a forex broker is the next step in your trading journey. We’ve covered a few great options that you may want to check out. To begin, visit the website of your chosen broker and look for the “Sign Up” or “Register button. Clicking on this button will take you to the registration page, where you’ll be required to fill out a form with your personal details. This usually includes your full name, email address, phone number, and country of residence.

Once you’ve filled out the necessary information, you’ll need to choose a username and password for your trading account. Think of a strong password to secure your account. Some brokers may require you to agree to their terms and conditions before proceeding.

Step 3 – Verifying Your Account

After completing the registration form, you may receive a verification email from the broker. Click on the verification link in the email to confirm your email address and activate your account. Next, you’ll need to verify your identity, which is a standard procedure implemented by brokers to ensure the security of your account and compliance with regulatory requirements.

To verify your account, you must provide a government-issued ID such as a passport, driver’s license, or national ID card. Ensure the document is valid and contains your full name, date of birth, and a clear photo. In addition to identification documents, brokers often require proof of address. This could be a utility bill, bank statement, or official government document that clearly shows your name and residential address.

Step 4 – Making Preparations and Selecting Currency Pairs

Before trading forex, decide which currency pairs you want to trade. Here are some pointers to help you pick:

- Understand the Forex Market: Take the time to educate yourself about the Forex market and how it operates. Learn about the major currency pairs, their characteristics, and factors influencing exchange rates. Understanding the basics will help you make an informed decision when selecting currency pairs.

- Assess Your Trading Goals and Risk Tolerance: Determine what level of risk you’re comfortable with and your trading goals. Are you looking to generate short-term profits through day trading, or are you interested in long-term investment opportunities? Assessing these factors will help you choose a suitable currency pair that aligns with your trading goals.

- Research Currency Pairs: Research different currency pairs to identify trading opportunities. Consider factors like volatility, liquidity, and market trends when evaluating currency pairs. Focus on pairs that show strong trends as they are more predictable for beginners.

- Analyze Market Conditions: Analyze market conditions and economic indicators to identify profitable currency pairs to trade. Pay attention to factors such as interest rates, economic data releases, world events, and bank policies that can influence prices.

- Diversify Your Portfolio: Diversification helps spread risk and allows you to take advantage of different market opportunities. Consider trading a range of currency pairs to balance your portfolio.

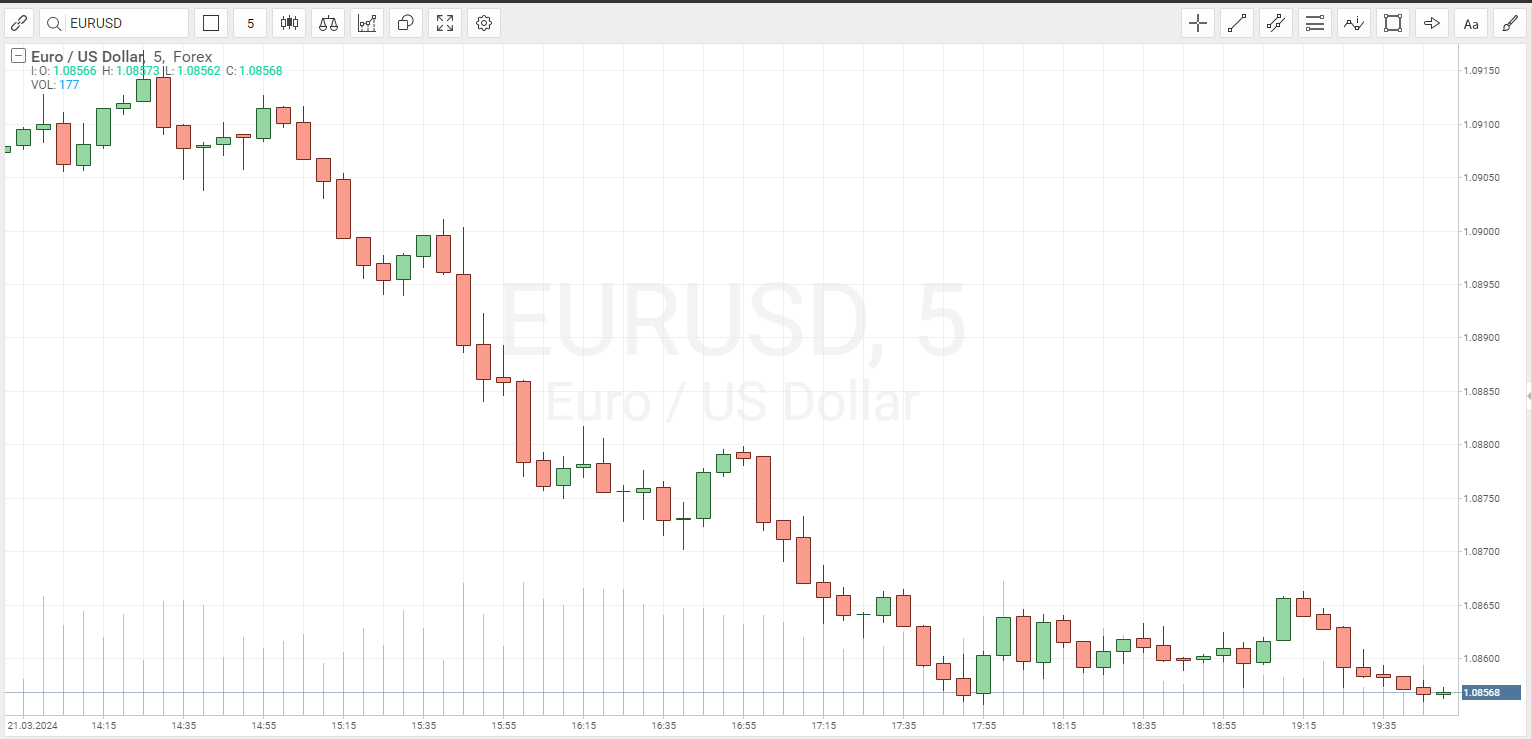

Step 5 – Finding Entry Points

Finding entry points is crucial for maximizing profits and trading efficiently. Here’s what professional traders do to know when it’s the right time to enter a trade:

- Technical Analysis: Utilize technical analysis tools such as support and resistance levels, trendlines, and chart patterns to identify potential entry points. Look for instances where the price approaches a support or resistance level, breaks out of a trend line, or forms recognizable chart patterns, like triangles or head and shoulders patterns.

- Indicators: Use technical indicators such as moving averages, Relative Strength Index, and Moving Average Convergence Divergence to confirm entry signals.

- Candlestick Patterns: Pay attention to candlestick patterns such as engulfing patterns, pin bars, and hammer patterns to identify reversals or continuation signals. These patterns provide visual cues about market sentiment and can help pinpoint entry points with precision.

- Fundamental Analysis: Look for opportunities to enter trades based on fundamental analysis. You can look at trends, emerging news, and financial events impacting currency pairs.

By combining these aspects, beginners will have an easier time finding entry points and capitalizing on price fluctuations.

Step 6 – Identifying Exit Points

Just as crucial as finding entry points, identifying exit points is essential for successful forex trading. Exit points determine when to close a trade and lock in profits or cut losses. Beginners can use various methods to spot exit points effectively.

Like with entry points, beginners can use technical analysis tools such as support and resistance levels, trend lines, and chart patterns to find exit points. Also, technical and fundamental analysis will provide more information on when to exit a trade. Consider using the tools we mentioned in the previous step, as they are effective for finding exit points as well as entry points.

Introducing Forex Trading Strategies:

Forex trading strategies are essential for beginners to implement as they make trading and becoming profitable easier. These strategies provide a systematic approach to trading, helping beginners make informed decisions and avoid making mistakes. Below, we’ll take a look at a few novice-friendly strategies.

Trend Following Strategy

The trend-following strategy is a beginner-friendly approach to forex trading that focuses on identifying and capitalizing on prevailing market trends. Traders use this strategy to ride the momentum of price movements by entering positions in the direction of the established trend. The process begins with analyzing the market to determine the predominant trend.

Once the trend direction is established, traders look for suitable entry points to join the trend. This often involves waiting on pullbacks or retracements in an uptrend to enter long positions or rallies in a downtrend to enter short positions. Trades will utilize technical indicators or trend continuation patterns to identify optimal entry opportunities.

Swing Trading Strategy

Swing trading is one of the most popular trading strategies in forex. The aim is to capitalize on short to medium-term price movements within a larger trend. Not to be confused with day trading, which involves executing trades within a single day, swing trading allows traders to hold positions for several days or weeks to take advantage of price fluctuations.

The goal of swing trading is to enter the market when the market swings low or high, depending on the type of trade you intend to do. Once the market reaches its low or high, traders take their position, anticipating a reversal or continuation of the trend.

To implement this strategy effectively, traders must have a keen understanding of market dynamics and be able to spot reversal or continuation signals. This may involve using technical analysis tools such as moving averages, Fibonacci retracement levels, and support and resistance zones to confirm entry points.

Scalping Strategy

Scalping is a high-frequency trading strategy commonly used in forex markets. It focuses on profiting from small price movements throughout the trading day. Unlike swing trading or trend following, which involve holding positions for days or weeks, scalpers aim to profit from rapid price changes that occur within minutes or even seconds.

The goal of scalping is executing a large number of trades within a short period, aiming to accumulate small gains over multiple orders. Scalpers target high-liquid currency pairs with tight spreads, allowing them to enter and exit positions quickly with minimal fees.

To do this stratergy effectively, traders must have access to low-latency trading platforms and be able to react quickly to market fluctuations. Scalpers often use technical analysis tools like moving averages, stochastic oscillators, and Bollinger Bands to spot short-term price patterns and entry points.

Fees and Costs in Forex Trading

Fees impact profitability, so knowing the many costs of forex trading is important. Underneath are the main costs of forex trading.

- Spread: The spread is the difference between the buying and selling price of a currency pair. It’s the broker’s commission for executing trades, which is measured in pips. Spreads vary depending on the currency pair and market conditions.

- Commissions: Some brokers will charge commissions on trades in addition to the spread. Commissions are charged as a percentage of the trade’s value or a fixed amount per lot traded.

- Overnight Financing: Overnight financing, also known as swap or rollover fees, is the interest rate differential between the two currencies in a currency pair. When traders hold positions overnight, they may incur or earn swap fees depending on the direction of their trade and the interest rates.

- Slippage: Slippage happens when the execution price of a trade differs from the requested price. This often happens during periods of high volatility or low liquidity, resulting in trades being executed at less favorable prices.

- Deposit and Withdrawal Fees: Transferring money to the broker can cost money depending on your payment method. Also, withdrawing from the platform can cost money as specific payment options have fees.

- Inactivity Fee: Inactivity fees may be charged by brokers for accounts that have not traded for an extended period. These fees are designed to encourage active trading and account maintenance.

Mastering Forex Trading

Achieving mastery in forex trading is the ultimate goal for beginners aspiring to become successful. However, learning alone is the most difficult way to become an expert in this field. Therefore, you’ll want to use multiple educational resources and help from experts to gain the most knowledge. This section covers 3 great resources for beginners looking to master forex trading.

Forex Trading Course at Witzel Trading

Witzel Trading offers a comprehensive range of forex trading courses designed for beginners. Focusing on practical, real-world trading techniques and strategies, these courses provide valuable insights and knowledge to help traders navigate the complexities of the forex market successfully. Beginners will find these courses filled with helpful tips, guides, and advice that will aid them in becoming a successful forex trader.

However, if you’re an advanced trader or already have knowledge in this field, some of the guides can still be helpful because they expand on winning strategies. Also, you’ll receive up-to-date information about the market and developing trends.

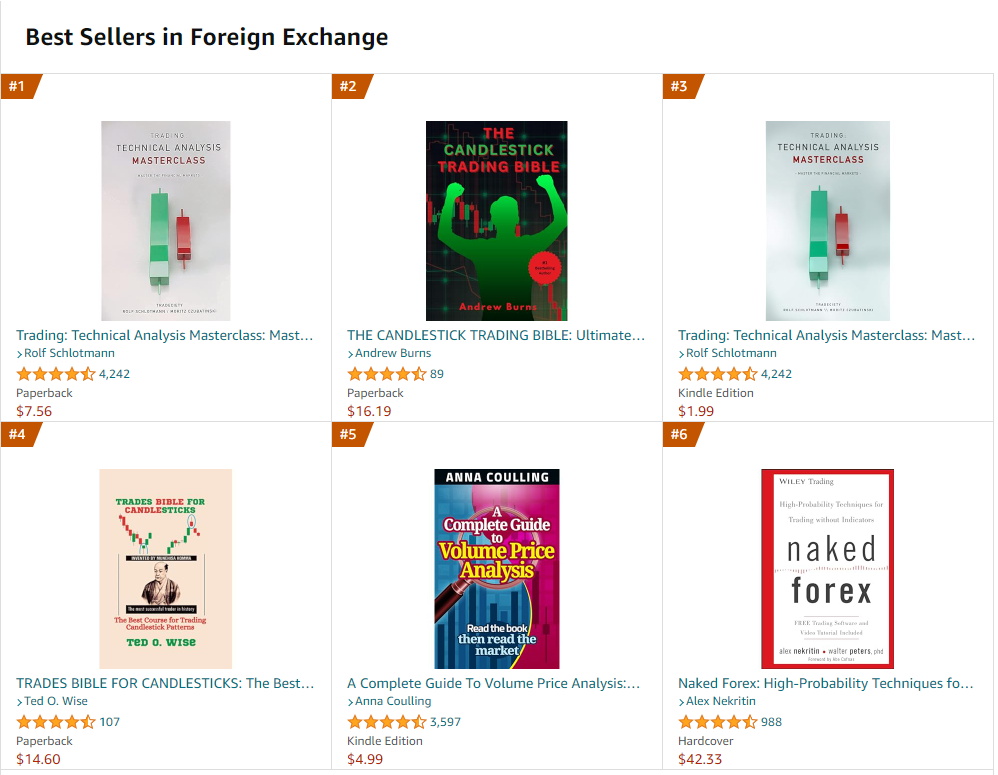

Forex Trading Books

Books are an invaluable resource for traders seeking to enhance their knowledge and skills in forex trading. Whether you’re a beginner looking to learn the basics or an experienced trader looking for advanced strategies, there are countless books available to read.

Here are some of our recommendations for forex trading:

- Currency Trading for Dummies: This beginner-friendly book provides a comprehensive overview of the forex market, covering topics such as currency pairs, trading terminology, risk management, and technical analysis.

- Japanese Candlestick Charting Techniques: This book teaches traders the fundamentals of candlestick charting and explores advanced techniques for interpreting candlestick patterns in the forex market.

- Market Wizards: This book features interviews with some of the world’s most successful traders, offering insights into their strategies, mindsets, and approaches to risk management.

- Trading in the Zone: This book explores the psychological aspects of trading and the importance of mindset and discipline in achieving trading success. Traders will learn how to cultivate a winning mindset, manage emotions, and maintain consistency in their trading performance.

Videos

Videos offer an engaging way to learn forex trading, providing various teaching styles that beginners can understand. Platforms like YouTube offer thousands of videos on forex education, offering tutorials, market analysis, and live trading sessions. These channels, run by successful traders and educators, provide valuable insights into trading strategies and risk management for free.

Moreover, online courses offer comprehensive video content covering a wide range of forex trading topics. Platforms like Udemy and Coursera feature courses created by industry experts providing in-depth tutorials and demonstrations to help beginners.

Understanding Taxes on Forex Trading Profits

Forex trading profits are subject to taxation, with specific tax treatment depending on the trader’s jurisdiction and local tax laws. Generally, profits generated from forex trading are considered taxable income and may be subject to either capital gains tax or income tax, depending on the classification by tax authorities.

For most traders, forex trading profits are treated as capital gains, especially if the trading activity is considered an investment rather than a business. In such cases, traders are required to report their net gains or losses from forex trading on their annual tax returns and pay taxes accordingly.

On the other hand, some jurisdictions may classify forex trading profits as ordinary income, subjecting them to the same tax rates as other sources of income. Traders in these regions must report their trading profits as part of their overall income and pay taxes based on their respective income tax brackets.

Forex Trading vs Other Investment Forms

When considering investment options, individuals often weigh the pros and cons of forex trading against other traditional investment forms. While forex trading offers unique profit opportunities, it also presents distinct differences and challenges compared to other investment vehicles. Here are some comparisons between forex trading and other popular investment forms:

- Stocks: Investing in stocks involves buying shares of publicly traded companies with the goal of profiting from increases in stock prices or dividend payments. Unlike forex trading, which focuses on currency pairs, stock trading requires purchasing ownership in specific companies. While forex trading offers high liquidity and the ability to profit from rising and falling markets, stock investors may benefit from dividends, stock splits, and capital appreciation over time.

- Bonds: Bonds are debt securities issued by governments or corporations, offering fixed interest payments and return of principal at maturity. Bond investors earn income through interest payments, making them a popular choice for income-oriented investors seeking steady cash flow. Forex, on the other hand, is speculative and more volatile in comparison.

- Mutual Funds/ETFs: Mutual funds and exchange-traded funds (ETFs) pool investors’ money to invest in a diversified portfolio of stocks, bonds, or other assets. These investment vehicles offer individual investors professional management, diversification, and ease of access. Unlike forex trading, which requires active monitoring and decision-making, mutual funds and ETFs provide passive investment options suitable for a hands-off approach to investing.

Conclusion – Full of Opportunities and Risks

To summarize, forex trading offers promising opportunities and inherent risks. While it provides accessibility and the potential for significant profits, it requires cautious risk management and disciplined trading strategies to be successful. Beginners should approach forex trading with diligence, recognizing the challenges and staying committed to continuous learning.

By seeking guidance from experienced traders like on the Witzel Trading platform, individuals can significantly increase their chances of becoming successful in the forex market. We’ve covered everything you need to know to start forex trading. Now, it’s up to you to apply this knowledge and start trading.

Frequently asked questions on Forex Trading:

Is Forex Trading a Good Investment?

The answer depends on the individual trading and their mindset. Forex trading can be a lucrative investment opportunity for those with the right knowledge, skills, and discipline. Success in forex trading depends on thorough market analysis, effective risk management, and implementing working strategies.

How Does Forex Trading Work?

Forex trading requires buying and selling currency pairs in the foreign exchange market. Traders aim to profit from fluctuations in exchange rates by speculating on whether a currency will strengthen or weaken relative to another. Trading is done through online trading platforms provided by forex brokers.

Is Forex Trading Like Gambling?

No, forex trading is fundamentally different from gambling. While both involve risk, forex trading requires analysis and strategies, whereas gambling relies primarily on luck.

Can I Make a Living Trading Forex?

Yes, making a living trading forex is possible, but it requires dedication, skill, and continuous learning. Successful forex traders treat trading as a business, stocking to a trading plan, managing risk effectively, and always improving their strategies. That being said, making a living from forex is difficult for a beginner but not impossible.